StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Calculating the Profit of the Geeto Product

Free

Calculating the Profit of the Geeto Product - Assignment Example

Summary

The paper "Сalculating the Profit of the Geeta Product" presents that Geeta plc Company produces components which it sells through the shipping industry. The managing director, Mr. Banks is in a search to get the ways of controlling the costs and improve the company performance…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER92.4% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Ph.D.

- Pages: 5 (1250 words)

- Downloads: 0

- Author: kamille16

Extract of sample "Calculating the Profit of the Geeto Product"

Geeta plc Management Accounting Department: Geeta plc Company produces components which it sells through the shipping industry. The managing director, Mr. Banks is in a search to get the ways of controlling the costs and improve the company performance. He has to refer to last month report so as to determine ways of cost control and company improvement.

Question A

First Mr. Bank needs to make reconciliation budgeted profit with Actual Profit of Product Geeto for the last month; we need to calculate all the variances. The variances are calculated according to their specifications. The specifications are material, labor or overheads

Variance.

In material variances, we calculate the material price variance and material usage variance.

1. Material

i) Material Price Variance.

(standard price – Actual price) Actual quality purchased

M P V = (SP – AP) A Q

L 10 = (1.55 – 0.625) 1050 = 971.25 A

L 17 = (1.75 – 1.9) 1470 = 220.50 F

750.75 A

ii) Material Usage Variance

(Standard quality of material used – Actual quality of material used) *Standard price

M U V = (S Q – A Q) S P

L 10 = (1278 – 1050) 1.55 = 353.4 F

L 17 = (1448.4 – 1470) 1.75 = 37.8 A

315.6 F

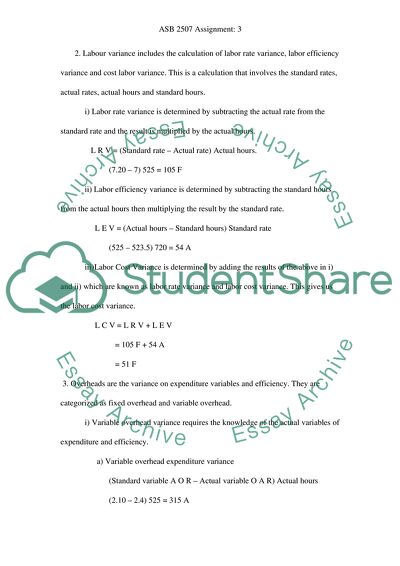

2. Labour variance includes the calculation of labor rate variance, labor efficiency variance and cost labor variance. This is a calculation that involves the standard rates, actual rates, actual hours and standard hours.

i) Labor rate variance is determined by subtracting the actual rate from the standard rate and the result is multiplied by the actual hours.

L R V = (Standard rate – Actual rate) Actual hours.

(7.20 – 7) 525 = 105 F

ii) Labor efficiency variance is determined by subtracting the standard hours from the actual hours then multiplying the result by the standard rate.

L E V = (Actual hours – Standard hours) Standard rate

(525 – 523.5) 720 = 54 A

iii)Labor Cost Variance is determined by adding the results of the above in i) and ii) which are known as labor rate variance and labor cost variance. This gives us the labor cost variance.

L C V = L R V + L E V

= 105 F + 54 A

= 51 F

3. Overheads are the variance on expenditure variables and efficiency. They are categorized as fixed overhead and variable overhead.

i) Variable overhead variance requires the knowledge of the actual variables of expenditure and efficiency.

a) Variable overhead expenditure variance

(Standard variable A O R – Actual variable O A R) Actual hours

(2.10 – 2.4) 525 = 315 A

b) Variable overheads efficiency variance

(Standard hours – Actual hours) Standard variable O A R

(532.5 – 525) 2.10 = 15.75 F

ii) Fixed overhead variance requires the calculations of fixed variances of expenditure, efficiency variance and volume variance to be able to calculate and determine it.

a) Fixed overhead expenditure variance

(Budgeted fixed O I H – Actual output O I H)

(4792.5 – 4725)

=67.5 F

b) Fixed O I H volume variance

(Budgeted output – Actual output) Standard fixed O I H O A R

(2130 – 2100) 9

= 270 F

c) Fixed overhead efficiency variance

Fixed O I H (Actual – Standard)

O A R hrs hrs

9 (525 – 532.5)

= 67.5 F

4. Sales Margin variances are determined by calculating the sales margin in price variance and sales margin in quantity variance. The addition of both sales margin in price variance and sales margin in quantity variances gives a result known as total sales margin variance.

i) Sales margin price variance

(Standard Price – Actual Price) Actual quantity sold

(15.00 – 14.50) 2100

= 1050 A

ii) Sales margin quantity variance

(budgeted quantity – Actual quantity) Standard margin / Standard profit per unit

(2130 – 2100) * (15 -14.50)

30 * 0.5

=15 A

iii) Total sales margin

Sales margin price variance + Sales margin quantity variance

1050 + 15 A

= 1065 A

Cost Statement

The cost statement gives the final calculations that finalizes in getting the final profit for the company. This is vital in managing the accounting of the company. The accounts will help Mr. Bank in improving the productivity of the company.

Budgeted Actual

Sales 31950 30450

Less: Cost of sales

Direct material

L 10 1627.5 1680

L 17 2572.5 2793

Direct labor 3834 3675

Variable O I H 1118.25 1260

Fixed O I H 479.25 4725

Net Profit. 18005. 25 16317

Reconciliation Statement

The reconciliatory statement is very vital for Mr. Bank to know budgeted profit and the actual profit of the company. This must involve the calculation of the variances of the last month in more detailed manner.

Budgeted profit 18005.25

Favorable Adverse

Sales margin price

Variance 1050

Sales margin quality

Variance 15 1065 A

16940.25

Material price variance 750.75

Material usage variance 315.6 435.15 A

16505.1

Labor rate variance 105

Labor eff. Variance 54 51 F

16556.1

Variable O I H ex. variance 315

Variable O I H eff. Variance 15.75 299.25 A

16256.85

Fixed O I H exp. Variance 67.5

Fixed O I H vol. variance 270 337.5 F

Actual Profit 16317

Question B

From the above information, Mr. Bank will realize that there is a number of variance that may have occurred. The reasons why the variances may have occurred are:-

i) The adverse variances might have occurred due to the excess expenditure of things like materials, overheads and the labor cost which may indicate the misuse of the funds provided.

ii) There might also be wastage of the materials in case of an adverse variance.

iii) The favorable variances might have been there due to the awareness of the individual commodities. Managers who might have regulated the use of the particular product so as to get a positive variance.

The reasons for inter-relationship between the variances in Geeta plc company are:-

i) If material used is adverse, most likely the labor cost will be high since the labor needed to manufacture the material may be high.

ii) The overheads may also be much since the overheads need depended on the labor hours needed thus increase the value of the overheads.

iii) It the price or cost of the material is low , the price of labor may also be low thus reducing the price of the overheads needed in the production or manufacturing process.

Question C

ABC is known as the Activity Based Costing. It is an accounting method that gives alternative from the traditional method. this costing model identifies the activity ceters or the cost pools in the company and delegates the costs to services and products. This delegation is always based on the transactions or events that are involved in the whole process that provides a product or service. This method is best known for managers who have the vision to maximize the value of shareholders and have the desire ti improve the corporate performance. ABC financial management method in relation to the traditional method (Andreas, 2007)

i) Intention of ABC method

1. ABC is intends to identify the organization’s main activities

2. ABC intends to identify the cost of the major activities in the organization.

3. ABC identifies the main cost drivers.

4. ABC recognizes the complexities in a production that increases the overtime.

5. ABC facilitates the deeper understanding of the cost drivers and the organization’s activities.

ii) In comparison with the traditional method:-

1. ABC helps to calculate the cost of each specific overhead in the production process but the traditional method gives out the cost of all the production overheads as one unit.

2. ABC shows the individual cost drivers which help show the things that causes the price change but the traditional method does not explain the reason of the price change.

3. ABC method is costly thus is more expensive than the traditional method.

4. ABC is more complex than the traditional method which may prove to be hard to the people that practice using it.

5. ABC method is more tedious and time consuming than the traditional method due to the calculation of the individual costs of each overhead used in production.

iii) Whether it may affects the calculations in part A

Yes it will affect the calculations in part A since it will require us to know all the production overheads used in the production process, then we should find the major activities in the organization , find the cost of the major activities, find the cost of the drivers of the different overheads and afterwards calculate the cost of the overheads. This may give us a different summation in the cost of the total overheads which in most cases, the cost will be more than that calculated in the traditional or conventional method.

Bibliography

Andreas, L. (2007). Activity Based Costing. Notderstedt.

Read

More

CHECK THESE SAMPLES OF Calculating the Profit of the Geeto Product

Core Activities of Associated British Foods Plc

The value of the profit margin was calculated from the adjusted profit before tax amounting to 613 million whilst total sales amounted to 6,800 million.... the profit margin for the year is slightly lower than the previous year's figure of 9.... the profit margin went down slightly because of losses from currency transactions when translating non-sterling revenues to sterling revenues.... billion in line with operating profit, which increased by 11% to 622 million in 2007....

8 Pages

(2000 words)

Case Study

The Possible Use of Ethanol as a Replacement for Petrol

The paper "The Possible Use of Ethanol as a Replacement for Petrol" discusses that there are various ways to achieve that so it is prudent to distinguish where subsidization may occur between the various stages in the production and marketing process.... ... ... ... The conversion of beets or corn into ethanol is touted by scientists today as an economically and environmentally sound solution to pressing national and global concerns....

12 Pages

(3000 words)

Essay

Management accounting

That means that there may be a lot of money in circulation and that will make the customers to purchase more of the product.... If the standard of living among people improves, that will imply that the customers will be able to purchase more of the product and that will make the actual results to be better than the budgeted.... That means that the aim of carrying out an advertisement is to increase the sales volume of a product.... In our case, the actual profit was less than the budgeted that implies that the economy could have worked against the sales....

8 Pages

(2000 words)

Essay

Management accounting

This can be as a result of a price cut so as to stimulate demand for product Geeta due to the increased competition in the shipping industry.... osting systems help a company to determine the relevant cost of a product.... This indicates that the number of units the company budgeted to sales were greater on aggregate basis, as compared to the actual number of units sold during....

5 Pages

(1250 words)

Essay

Management accounting

Actual profit is calculated to be £ 16317 while the original budgeted profit is £ 18339.... .... The following variances will be used:

... ... he adverse selling price.... ... ... ce may be due to unplanned price reduction from the planned £ 15.... 0 to £ 14....

5 Pages

(1250 words)

Essay

Geeta Public Limited Company: Variances and Just-in-Time

This essay "Geeta Public Limited Company: Variances and Just-in-Time" aims at preparing a statement giving the budgeted, actual, and variances.... In order to draw up the income statement, the paper presents calculations showing the possible variances using the financial data Geeta plc.... ... ... ...

6 Pages

(1500 words)

Essay

Common Mistakes Made by Business Media Authors

This past year, the Federal Reserve banks managed to rack up a profit of $52 million, with most of the extra money coming from the government securities they bought trying to stabilize finances.... Adding this to the fact that China has a greater population than America only drives the point home that the Chinese market is where the profit is....

36 Pages

(9000 words)

Research Paper

Management Activity Based Costing

In the calculations above, applying ABC will change the amount of overhead absorbed by the product.... The cost accounting information used in the above calculations is for a single product.... The paper "Management Activity Based Costing" presents that economic activities require a guideline when being undertaken....

8 Pages

(2000 words)

Research Paper

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Calculating the Profit of the Geeto Product"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY