StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- White Company Inventory

Free

White Company Inventory - Assignment Example

Summary

The paper "White Company Inventory" is a great example of a finance and accounting assignment. The January beginning inventory of the White Company consisted of 300 units costing $40 each. During the first quarter, the company purchased two batches of goods: 700 Units at $44 on February 21 and 800 units at $50 on March 28…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER95% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: High School

- Pages: 5 (1250 words)

- Downloads: 0

- Author: lexieleuschke

Extract of sample "White Company Inventory"

Week Three Exercise Assignment Inventory Specific identification method. Boston Galleries uses the specific identification method for inventory valuation. Inventory information for several oil paintings follows.

Painting

Cost

1/2 Beginning inventory

Woods

$11,000

4/19 Purchase

Sunset

21,800

6/7 Purchase

Earth

31,200

12/16 Purchase

Moon

4,000

Woods and Moon were sold during the year for a total of $35,000. Determine the firm’s

a. cost of goods sold.

$11,000+$4,000= $15,000

b. gross profit.

Sales-Cost of goods sold= Gross Profit

$35,000-$15,000= $20,000

c. ending inventory.

$21,800+$31,200= $53,000

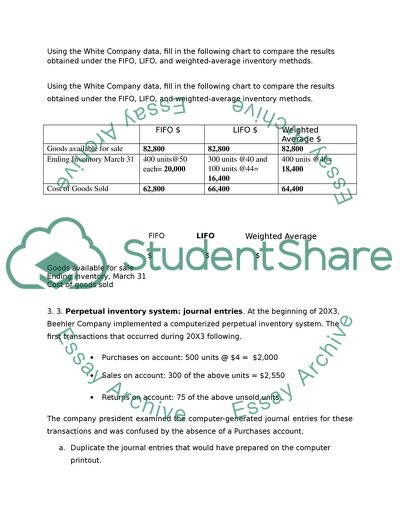

2. Inventory valuation methods: basic computations. The January beginning inventory of the White Company consisted of 300 units costing $40 each. During the first quarter, the company purchased two batches of goods: 700 Units at $44 on February 21 and 800 units at $50 on March 28. Sales during the first quarter were 1,400 units at $75 per unit. The White Company uses a periodic inventory system. Using the White Company data, fill in the following chart to compare the results obtained under the FIFO, LIFO, and weighted-average inventory methods.

Using the White Company data, fill in the following chart to compare the results obtained under the FIFO, LIFO, and weighted-average inventory methods.

FIFO $

LIFO $

Weighted Average $

Goods available for sale

82,800

82,800

82,800

Ending Inventory March 31

400 units@50 each= 20,000

300 units @40 and 100 units @44= 16,400

400 units @46= 18,400

Cost of Goods Sold

62,800

66,400

64,400

FIFO

LIFO

Weighted Average

Goods available for sale

$

$

$

Ending inventory, March 31

Cost of goods sold

3. 3. Perpetual inventory system: journal entries. At the beginning of 20X3, Beehler Company implemented a computerized perpetual inventory system. The first transactions that occurred during 20X3 following.

Purchases on account: 500 units @ $4 = $2,000

Sales on account: 300 of the above units = $2,550

Returns on account: 75 of the above unsold units

The company president examined the computer-generated journal entries for these transactions and was confused by the absence of a Purchases account.

a. Duplicate the journal entries that would have prepared on the computer printout.

Account

Debit

Credit

Inventory

Accounts Payable

500 units @ $4 = $2,000

2,000

2,000

Sale

Accounts Receivable

2,550

2,550

Accounts Payable

Inventory

75 units @ $4 = $300

300

300

b. Calculate the balance in the firm’s Inventory account.

125 units @ $4 each= $500

c. Briefly explain the absence of the Purchases account to the company president.

The purchase account is used in periodic inventory system. Inventory account is directly debited when inventory is purchased under perpetual inventory system because inventory account has to be kept updated.

4. Inventory valuation methods: computations and concepts. Wave Riders Surfboard Company began business on January 1 of the current year. Purchases of surfboards were as follows:

1/3:

100 boards @ $125

3/17:

50 boards @ $130

5/9:

246 boards @140

7/3:

400 boards @ $150

10/23:

74 boards @ $160

Wave Riders sold 710 boards at an average price of $250 per board. The company uses a periodic inventory system.

Instructions

a. Calculate cost of goods sold, ending inventory, and gross profit under each of the following inventory valuation methods:

First-in, first-out

Cost of Goods Sold $100,540

Ending Inventory $24,740

Gross Profit $76,960

Last-in, first-out

Cost of Goods Sold $104,880

Ending Inventory $20,400

Gross Profit $72,620

Weighted average

Cost of Goods Sold $102,240 710 @144 per unit cost

Ending Inventory $23,040

Gross Profit $75,260

b. Which of the three methods would be chosen if management’s goal is to

(1) produce an up-to-date inventory valuation on the balance sheet?

FIFO

(2) approximate the physical flow of a sand and gravel dealer?

Weighted Average

(3) report low earnings (for tax purposes) for a separate electronics company that has been

experiencing declining purchase prices?

FIFO

5. Depreciation methods. Betsy Ross Enterprises purchased a delivery van for $30,000 in January 20X7. The van was estimated to have a service life of 5 years and a residual value of $6,000. The company is planning to drive the van 20,000 miles annually. Compute depreciation expense for 20X8 by using each of the following methods:

a. Units-of-output, assuming 17,000 miles were driven during 20X8

Account

Debit

Credit

Depreciation Expense

Accumulated Depreciation

4,080

4,080

b. Straight-line

Account

Debit

Credit

Depreciation Expense

Accumulated Depreciation

4,800

4,800

d. Double-declining-balance

1/5= 0.2= 20%

Depreciation (double declining balance) = 2 x 20% x 30,000= 12,000

Account

Debit

Credit

Depreciation Expense

Accumulated Depreciation

12,000

12,000

6. Depreciation computations. Alpha Alpha Alpha, a college fraternity, purchased a new heavy-duty washing machine on January 1, 20X3. The machine, which cost $1,000, had an estimated residual value of $100 and an estimated service life of 4 years (1,800 washing cycles). Calculate the following:

a. The machine’s book value on December 31, 20X5, assuming use of the straight-line depreciation method

Book Value= $325 (after end of 3 years)

b. Depreciation expense for 20X4, assuming use of the units-of-output depreciation method. Actual washing cycles in 20X4 totaled 500.

500/1800 (1,000-100) = $250

c. Accumulated depreciation on December 31, 20X5, assuming use of the double-declining-balance depreciation method.

2003: 2 x 25% x 1,000= 500

2004: 50% x 500= $250

2005: 50% x 250= $125

7. Depreciation computations: change in estimate. Aussie Imports purchased a specialized piece of machinery for $50,000 on January 1, 20X3. At the time of acquisition, the machine was estimated to have a service life of 5 years (25,000 operating hours) and a residual value of $5,000. During the 5 years of operations (20X3 - 20X7), the machine was used for 5,100, 4,800, 3,200, 6,000, and 5,900 hours, respectively.

Instructions

a. Compute depreciation for 20X3 - 20X7 by using the following methods: straight line, units of output, and double-declining-balance.

Straight Line

2003: Depreciation= $9,000

2004: Depreciation= $9,000

2005: Depreciation= $9,000

2006: Depreciation= $9,000

2007: Depreciation= $9,000

Units of Output

2003: 5100/25000 ($50,000-$5,000) = $9,180

2004: 4800/25000 ($50,000-$5,000) = $8,640

2005: 3200/25000 ($50,000-$5,000) = $5,760

2006: 6000/25000 ($50,000-$5,000) = $10,800

2007: 5900/25000 ($50,000-$5,000) = $10,620

Double-Declining-Balance

2003: 40% (50,000) = $20,000

2004: 40% (30,000) = $12,000

2005: 40% (18,000) = $7,200

2006: 40% (10,800) = $4,320

2007: 40% (6,480) = $2,592 but this will lead to a residual value of 3,888 which is less than 5,000

The depreciation of 2007 will be $1,480

b. On January 1, 20X5, management shortened the remaining service life of the machine to 20 months. Assuming use of the straight-line method, compute the company’s depreciation expense for 20X5.

2003: Depreciation= $9,000

2004: Depreciation= $9,000

Book value= $50,000-$18,000= $32,000

Depreciation Expense= $16,200 for 2005 ($32,000-$5,000)*12/20

c. Briefly describe what you would have done differently in part (a) if Aussie Imports had paid $47,800 for the machinery rather than $50,000 In addition, assume that the company incurred $800 of freight charges $1,400 for machine setup and testing, and $300 for insurance during the first year of use.

Freight charges and set up costs are included in the cost of the machinery. This will make the cost of the machinery (47,800+300+1400) $50,000 and this is why we will not have to change anything. Insurance is treated separately and has nothing to do with depreciation of an asset.

Reflect for a moment on the LIFO (Last in First Out) and FIFO (First in First Out) inventory methods. If you were starting a small manufacturing company, what inventory method do you believe would provide the most accurate financial statements? Why do you believe this is the case?

For a small manufacturing company, it is much better to use FIFO inventory method as it will provide the most accurate financial statements. This will be the case because inventory should be reflected in terms of recent prices and in the FIFO method it is assumed that inventory that is purchased first is sold first. This means that the inventory that is left unsold is the inventory that was most recently purchased. The inventory of the company is reported at its recent value which is why financial statements are up to date.

Using LIFO method will not produce very accurate financial statements because it will value inventory at older value which might be different from the current value of the inventory.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"White Company Inventory"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY