StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Determining Land Recoverys Current Ratio, Working Capital and ROE

Free

Determining Land Recoverys Current Ratio, Working Capital and ROE - Assignment Example

Summary

The paper "Determining Land Recoverys Current Ratio, Working Capital and ROE" is a great example of a finance and accounting assignment. Land recovery is considering several forms of financing its assets for next year…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.3% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Masters

- Pages: 5 (1250 words)

- Downloads: 0

- Author: titogutkowski

Extract of sample "Determining Land Recoverys Current Ratio, Working Capital and ROE"

Finance And Accounting s Determining Land Recovery’s Current ratio, working capital and ROE Table Option1

Option 2

Option 3

STD

24.00

18.00

12.00

Interest Rate on STD

5.5%

5.0%

4.5%

Interest on STD

1.32

0.90

0.54

LTD

1.00

7.00

13.00

Interest Rate on LTD

8.5%

8.0%

7.0%

Interest on LTD

0.09

0.56

0.91

Total Interest

1.41

1.46

1.45

Table 2:

Option 1

Option 2

Option 3

Expected EBIT

6

6

6

Interest Expense

1.41

1.46

1.45

EBT

4.59

4.54

4.55

Tax expense

1.836

1.816

1.82

Net Income

2.754

2.724

2.73

Option 1:

1. Current Ratio = Current assets/current liabilities

= 30/24 = 1.25

2. Net working capital = Current assets- current liabilities

= 30-24 = 6 million

3. Expected rate of return on stockholder’s equity= Expected NI/stockholder’s equity

= 2.754/40 = 6.89%

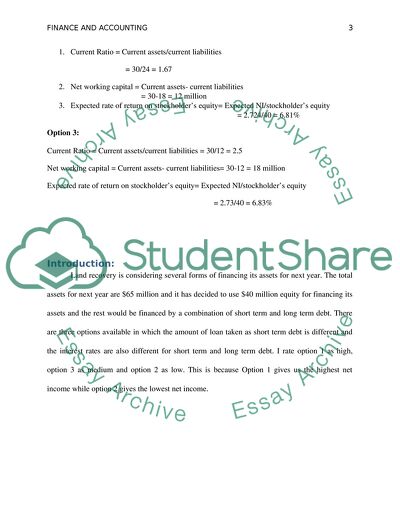

Option 2:

1. Current Ratio = Current assets/current liabilities

= 30/24 = 1.67

2. Net working capital = Current assets- current liabilities

= 30-18 = 12 million

3. Expected rate of return on stockholder’s equity= Expected NI/stockholder’s equity

= 2.724/40 = 6.81%

Option 3:

Current Ratio = Current assets/current liabilities = 30/12 = 2.5

Net working capital = Current assets- current liabilities= 30-12 = 18 million

Expected rate of return on stockholder’s equity= Expected NI/stockholder’s equity

= 2.73/40 = 6.83%

Introduction:

Land recovery is considering several forms of financing its assets for next year. The total assets for next year are $65 million and it has decided to use $40 million equity for financing its assets and the rest would be financed by a combination of short term and long term debt. There are three options available in which the amount of loan taken as short term debt is different and the interest rates are also different for short term and long term debt. I rate option 1 as high, option 3 as medium and option 2 as low. This is because Option 1 gives us the highest net income while option 2 gives the lowest net income.

Discussion

Capital Structure:

Capital structure of the company determines what portions of the assets are financed by debt and what portion is finance by equity. It is helpful in determining the risk levels of the company because if a company has debt which is higher than the optimal level, then the company becomes quite risky because in case it is not able to repay its debt holders, then it might go bankrupt. (Capital Structure)

In this case, the company will have the same capital structure as the amount of equity is fixed i.e. 40 million and therefore the rest of 25 million is financed by debt. The debt to total asset ratio for the company is 38.5% and the equity to assets ratio is 61.5% which shows that the company is majorly equity financed. The only difference that arises in the three options is the amount of short term and long term debt. Option 1 has the highest amount of short term debt and the lowest amount of long term debt and vice versa for option 3.these different ratios of short term and long term debt actually affect the cost of debt as STD and LTD have different interest rates.

Interest expense

Interest expense is an important component as a company has to pay interest otherwise it may go bankrupt. Therefore, it is very important for a company to consider its ability to pay interest. This can be seen by the times interest earned ratio which shows how much times of interest has the company earned. (Times interest earned ratio)

In all three options, the interest rate on long term debt is more than that of short term debt but option has the lowest interest rates for both long term and short term when compared to the other two options. We cannot make the decision only on the interest rates because, the amount of debt that we can take as STD is specified in all 3 options and therefore the remaining amount has to be the long term debt.

In option 1, we have to take $24 million as STD and the remaining 1 million will be LTD. The interest rate on short term debt is 5.5% and that on long term debt is 8.5%.this gives a total interest expense of 1.41 million.

In option 2, we have to take $18 million as STD and the remaining 7 million will be LTD. The interest rate on short term debt is 5.0% and that on long term debt is 8.0%.this gives a total interest expense of 1.46 million.

In option 3, we have to take $12 million as STD and the remaining 13 million will be LTD. The interest rate on short term debt is 4.5% and that on long term debt is 7.5%. This gives a total interest expense of 1.45 million. Although, this option has the lowest interest rates for both STD and LTD, but it still has an interest expense which is higher than option 1.this is because in this option, we can only take 12million as STD and the rest of 13 million is LTD on which we’ve to pay a higher interest rate of 7.5%.On the other hand in option 1 we have to pay a lower interest rate of 5.5% for most part of our debt while the higher rate of 8.5% needs to be paid for 1 million only.

Net Income

In this case we have expected EBIT through which we can get our expected Net income for next year under the different options.

In option 1, we get a Net Income of 2.754 million (table 2).We have expected EBIT of 6 million, interest charges of 1.41 million which gives EBT of 4.59 million. After that we deduct tax charges (40%) to get the expected Net Income of 2.754 million.

In option 2 we get expected net income of 2.724 million and in option 3 we get expected net income of 2.73 million. Therefore, according to the Net income, option 1 is the best option as it gives the highest profitability.

Current ratio:

If a company has current ratio which is too low, it implies that the current assets of the company are not enough to finance the current liabilities. On the other hand, if the current ratio is too high than it shows that these assets are kept idle and they are not being properly utilized. There is no fixed standard as to how much current ratio is good. It varies by industry to industry but if the current ratio falls below 1 then there is a real concern. (Kennon)

As far as these three options are concerned all of them have a current ratio of greater than 1 but option 3 has a very high current ratio i.e. 2.5 which shows that assets are being kept idle which is actually a cost for the company as they could use these assets elsewhere to earn a return. Therefore, option 3 is not good from the perspective of current ratio.

Net working capital

The net working capital is positive in all three options but it is the lowest in option 1 and the highest in option 3.this is because in option 1, we have taken a large amount of short term debt due to which our current liabilities have increased.Net working capital shows the margin that we have because it shows how much extra current assets we have than the current liabilities.

ROE

The return on equity is measured by dividing the net income earned by the stock holder’s equity. In this case, we have the highest ROE in option 1 and the lowest in option 2.ROE is an important measure of how well the company is earning on its stockholder’s equity. There ROE is a good indicator of which option is a better one. Therefore option can be rated high, option 3 medium and option 2 as low according to ROE.

Conclusion

After considering the different factors related to risk and profitability of the three different options, I would select option 1 as the most feasible option. This is because it gives the lowest interest expense, highest net income and return on equity. Moreover, the current ratio of 1.25 is also satisfactory and we also have a positive 6 million working capital in this option which is good enough.

Option 2 is not good because it gives the lowest Net income and ROE, although the current ratio is good. Option 3 is also not as good as one due to lower net income and ROE. Furthermore, option 3 is also not good as it gives a current ratio of 2.5 which is too high and indicates idle resources. Therefore, we can finally conclude that option 1 is the best option.

References

Capital Structure. (n.d.). Retrieved June 19, 2012, from Investopedia: http://www.investopedia.com/terms/c/capitalstructure.asp#axzz1yDqMVDdH

Kennon, J. (n.d.). The Current ratio. Retrieved June 19, 2012, from About.com-Investing for beginners: http://beginnersinvest.about.com/od/analyzingabalancesheet/a/current-ratio.htm

Times interest earned ratio. (n.d.). Retrieved June 19, 2012, from BIZWIZ consulting: http://www.bizwiz.ca/times_interest_earned_ratio.html

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Determining Land Recoverys Current Ratio, Working Capital and ROE"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY