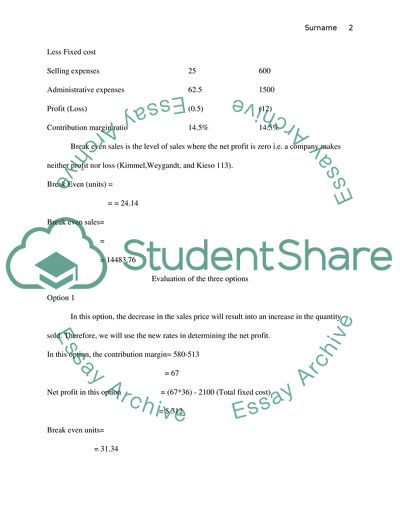

Answer the question for chapter 1,2,3,4and 5 Assignment - 1. https://studentshare.org/finance-accounting/1776027-answer-the-question-for-chapter-1234and-5

Answer the Question for Chapter 1,2,3,4and 5 Assignment - 1. https://studentshare.org/finance-accounting/1776027-answer-the-question-for-chapter-1234and-5.