StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Services Decision

Free

Financial Services Decision - Assignment Example

Summary

The paper “Finance Services Decision” is a valuable example of a finance & accounting assignment. Sports World is a huge retail chain with strong financial statements to back its impressive sales growth and can have a very bright future if it goes ahead with careful strategic expansion…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.5% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Business School

- Pages: 5 (1250 words)

- Downloads: 0

- Author: dax73

Extract of sample "Financial Services Decision"

Finance Services Decision Q Financial ment Analysis Sports World is a huge retail chain withstrong financial statements to back its impressive sales growth and can have a very bright future, if it goes ahead with careful strategic expansion.

2010

2009

2008

2007

2006

Profit Margin

4.36%

3.86%

4.19%

5.00%

5.20%

Gross Margin

40.0%

39.9%

42.0%

41.8%

41.8%

TIE

7.444

5.18

8.83

12.22

11.6

Asset Turnover

2.26

2.02

2.06

2.56

2.69

Return on Assets

9.9%

7.8%

8.6%

12.8%

14.0%

Return on Equity

20.5%

15.6%

17.0%

21.6%

23.2%

Debt Ratio

0.517

0.501

0.492

0.408

0.397

Current Ratio

2.39

2.75

2.26

2.68

2.83

Acid Ratio

0.684

0.954

0.866

1.13

1.20

Inventory Turnover

2.75

2.49

2.65

3.71

3.93

Q 1(a)

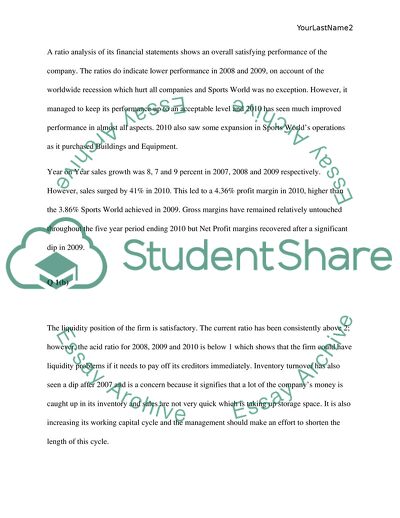

A ratio analysis of its financial statements shows an overall satisfying performance of the company. The ratios do indicate lower performance in 2008 and 2009, on account of the worldwide recession which hurt all companies and Sports World was no exception. However, it managed to keep its performance up to an acceptable level and 2010 has seen much improved performance in almost all aspects. 2010 also saw some expansion in Sports World’s operations as it purchased Buildings and Equipment.

Year on Year sales growth was 8, 7 and 9 percent in 2007, 2008 and 2009 respectively. However, sales surged by 41% in 2010. This led to a 4.36% profit margin in 2010, higher than the 3.86% Sports World achieved in 2009. Gross margins have remained relatively untouched throughout the five year period ending 2010 but Net Profit margins recovered after a significant dip in 2009.

Q 1(b)

The liquidity position of the firm is satisfactory. The current ratio has been consistently above 2; however, the acid ratio for 2008, 2009 and 2010 is below 1 which shows that the firm could have liquidity problems if it needs to pay off its creditors immediately. Inventory turnover has also seen a dip after 2007 and is a concern because it signifies that a lot of the company’s money is caught up in its inventory and sales are not very quick which is taking up storage space. It is also increasing its working capital cycle and the management should make an effort to shorten the length of this cycle.

The company’s cash flows have been managed efficiently. Financing has been done very well to pay for acquisition of assets in 2009 and 2010 and increase in the Accounts Payable allowed it to increase its cash flow from operating activities which demonstrates good bargaining power with its suppliers (Bull 2007, pp. 35-60).

The debt management ratios of Sports World are balanced overall. It is true that the debt ratio has risen since 2007; however, the Times Interest Earned (TIE) ratio has been at satisfactory levels apart from a fall in 2009. TIE ratio exhibits that the company has managed to earn substantial profit relative to its interest expense, which is all the more impressive since the company’s debt has actually increased in recent years.

Fundamentals of the company appear quite strong since its Returns on Assets as well as Equity rose in 2009 and 2010 after falling slightly in 2008. Return on equity is a very healthy sign for a company and in 2010 it was 20.5%.this follows from a 59% increase in Net Profit generated by the company (Besley and Brigham 2007, pp.51-63).

Q.2. Capital Structure Analysis

Q. 2(a)

Sports World’s capital structure is divided almost equally between debt and equity. The Debt Ratio for 2006 and 2007 remained around 40% but jumped to almost 50% for the next 3 years. The year-on-year increase in long-term debt taken on by the company was 50, 53 and 24 percent in 2008, 2009 and 2010 respectively. As the scale of operations grew in 2010, Sports World had an increase in Accounts Payable as spontaneously generated funds increased.

The company also increased its common equity by floating more of its shares; in 2008, common equity increased by 22% while in 2010 it increased by 5%. However, the company’s debts increased faster than its equity during this period; hence its capital structure has become more leveraged. That is not necessarily a bad thing; with the economy looking positive, and healthy increase in sales and profits, leveraged expansion could be just what the company needs. It is only when the overall macroeconomic environment is depressed and sales move into a slump that leverage can turn dangerous for a company; this is not the case for Sports World.

Q. 2(b)

Looking forward, if this buyout does go ahead, the company’s capital structure will be heavily towards debt since 250 million out of the 350 million will be financed by debt. Such a capital structure can prove to be beneficial as well as dangerous for this company. Its consequences depend on how well the management handles the operations in the coming years. A good cash flow will be required to ensure that interest payments are made on time.

Q.3. Pro Forma Analysis

Q. 3(a)

Projections of financial statements indicates that if the proposed expansions do take place, the company will be able to almost double its profit in five years’ time, relative to the levels achieved in 2010. Sales will have reached to above 430 million, while operating profits would be around the 40 million mark. However, increased financial charges mean that profitability will not be as high and will be around the 13 million mark. It is important to note that at the end of five years, the company will have to pay back the principle amounts on the bonds it issued and sufficient liquidity will be required for that.

Q.3(b)

Since the company will be leveraged after this buyout, it is important that the company’s cash flows are strong enough to keep up with the interest payment requirements that the company will face. The management wants to undertake massively aggressive expansion which can be dangerous. If sales do not increase by the required percentage, the company might well face liquidity problems which could lead it towards bankruptcy since it would not be able fulfill its obligations towards its debt holders. Therefore, it would be wise to structure the deals to finance this buyout in such a way that debt payments are required after a certain period of time so that there is not a great pressure on immediate performance of the company (Besley and Brigham 2007, pp.35-36).

Q. 4 Discussion of Alternatives

There do not exist many practical alternatives in this situation. Leveraged Buyouts (LBOs) have many advantages that include a potential improvement in operating performance, tax savings since interest is a tax-deductible expense, management incentives and more efficient decision processes under private ownership. However, there are numerous disadvantages to this strategy as well. There are high fixed costs of debt and vulnerability to business cycle processes and competitors’ actions. Apart from that, it is possible that the firm may have difficulty in raising capital. Another very important consideration is the feelings of the existing management towards the LBO. It is important to take them on board and gain their trust and cooperation to maximize their performance.

The structure of this LBO is that of a direct merger. This is the kind in which the seller receives cash for the stock. Once the appropriate security agreements are in place, the lender or lenders make loans to the buyer.

However, the management must focus on the operational performance of the firm so that the company does not falter when it comes to the debt payments obligation that it needs to fulfill. For this purpose, immediate attention must be given to ways to reduce the working capital cycle. To achieve this end, it is necessary to increase the accounts payables turnover by bargaining with suppliers, and reduce the period of collection from credit sales so that the company does not face liquidity issues.

Q. 5 Decision and Recommendations

Rapid expansion requires careful planning and is going to be vital in determining the success of this LBO. This is because 125 million that is to be borrowed as bonds will mature in five years and it is necessary that the firm has enough cash to be able to pay that. For this reason, I would recommend that loans be taken or bonds be issues with longer time to maturity so that the company has enough time to prove its worth and achieve its potential in order to be able to pay back its debt obligations. If that is not possible, it may be possible for Sports World to engage in Reverse Leverage Buyout. A reverse LBO will help the company obtain cash in order to bring the debt to more manageable levels.

Hence my recommendation is that Diamond Equity should try to alter the terms of the financing arrangement with the lenders because in the current scenario, Sports World will not be able to generate enough profits to pay back the loans that will be due in a few years.

1493 words

Works Cited

Besley, Scott, and Eugene F Brigham. Essentials of Managerial Finance. Mason: Cengage Learning, 2007. Google Book Search. Web. 23 Mar 2012.

Bull, Richard. Financial Ratios: how to use financial ratios to maximize value and success for your business. Oxford: Elsevier, 2007. Google Book Search. Web. 23 Mar 2012.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Financial Services Decision"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY