StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Statements of ThyssenKrupp Group after the Conversion from US GAAP to IFRS

Free

Financial Statements of ThyssenKrupp Group after the Conversion from US GAAP to IFRS - Assignment Example

Summary

The author explains how ThyssenKrupp Group Balance Sheet elements such as property, plant and equipment, inventories and minority interests change after the conversion from US GAAP to IFRS. The author also explains the income statement elements such as net sales and selling expenses…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER93.2% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: College

- Pages: 5 (1250 words)

- Downloads: 0

- Author: joelprohaska

Extract of sample "Financial Statements of ThyssenKrupp Group after the Conversion from US GAAP to IFRS"

MEMO

The adoption of IFRS 1 – First Time Adoption of International Financial Reporting Standards will require not only changes to the financial statements for the 2005/2006 fiscal year but also to the 2004/2005 fiscal year. The reason is that the financial statements for both periods have to be comparable. Comparability of financial statements between one period and the next is a requirement by IAS 1 Preparation and Presentation of Financial Statements. Therefore, the figures that were used in the Financial Statements for 2004/2005 will have to be adjusted according to the requirements of IFRS1. Some of the financial components that will be affected from the conversion from US GAAP include the treatment of intangible assets such as development costs, goodwill and intangible pension assets. Tangible assets such as property plant and equipment will require adjustments in how investment property is dealt with because of the differences in treatment under both methods. IFRS uses a components approach in dealing with property, plant and equipment and so they are shown separately – inclusive of the depreciation charged on these assets. Impairment of assets is also dealt with differently and most operating leases will now be classified as finance leases. This will have implications for profits and for the tangible assets balance in the balance sheet. Investment property will now be a separate line item on the balance sheet as a result of these changes. Under IFRS all non-current assets can qualify as assets held for sale while under US GAAP only long lived asset can, once they meet specific criteria. There are other interesting cases that will affect deferred tax assets, inventories, trade accounts receivables and other receivables such as embedded derivatives and prepaid pension costs. It is interesting to note that the measurement date of the pension plan will coincide with the year end and so this will affect the prepaid pension cost shown in the financial statements. The treatment of contracts will not only have implications for inventories but also accounts receivable, accounts payables and of course income and therefore the net profit of ThyssenKrupp. IFRS requires a different treatment for minority interest than that used under US GAAP. While US GAAP showed minority interest as a separate item between liabilities and equity IFRS requires that it be shown as part of equity. As a result of these changes the figures for the 2004/2005 will be very different. The differences relating to changes in equity and other elements are therefore required to be shown in the notes to the financial statements. IFRS 1 also requires that the differences be clearly explained so that the various stakeholders which includes, shareholders, analysts, prospective investors and others are able to understand them and their effects on the financial statements.

Finally, it is very important to note that IFRS1 defines an entity’s first IFRS financial statements as being the first annual financial statements in which an entity adopts IFRS by making it clear that IFRS is being complied with by way of an “unreserved” and “explicit” statement of that fact (Ernst & Young 2009).

The conversion from US GAAP to IFRS has impacted various elements of the financial statements. According to Ernst and Young (2009) the main principle is full retrospective application of IFRS standards that were in effect as of ThyssenKrupp’s first IFRS reporting period. Some of the elements of the financial statements have been impacted positively and some negatively.

The Balance Sheet elements that are explained below are: property, plant and equipment; inventories; and minority interests. The income statement elements that will be explained are: net sales; selling expenses; and other operating income

Balance Sheet Elements

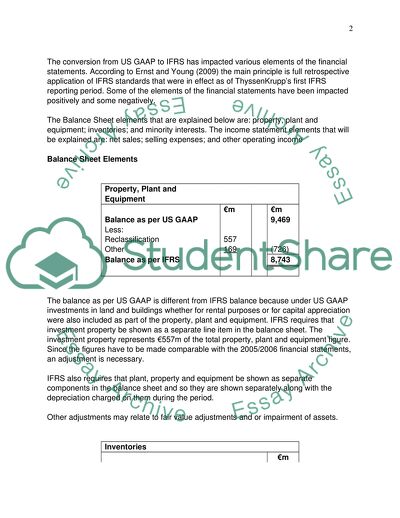

Property, Plant and Equipment

€m

€m

Balance as per US GAAP

9,469

Less:

Reclassification

557

Other

169

(726)

Balance as per IFRS

8,743

The balance as per US GAAP is different from IFRS balance because under US GAAP investments in land and buildings whether for rental purposes or for capital appreciation were also included as part of the property, plant and equipment. IFRS requires that investment property be shown as a separate line item in the balance sheet. The investment property represents €557m of the total property, plant and equipment figure. Since the figures have to be made comparable with the 2005/2006 financial statements, an adjustment is necessary.

IFRS also requires that plant, property and equipment be shown as separate components in the balance sheet and so they are shown separately along with the depreciation charged on them during the period.

Other adjustments may relate to fair value adjustments and or impairment of assets.

Inventories

€m

Balance as per US GAAP

7,439

Less: Reclassification

(577)

Balance as per IFRS

6,862

Under US GAAP the inventory item described as work-in-progress included construction contracts that were accounted for under the basis of the percentage of work that had been completed. With the adoption of IFRS these are no longer shown as part of inventory but have been reclassified to trade accounts receivable. The duration of the contracts are less than one year and so IFRS includes them as part of trade receivables. US GAAP only applies percentage of completion basis to contracts with durations greater than 12 months. The inventories balance has therefore been reduced by €577m and the trade receivables increased by the same amount to account for this change.

Minority Interest

€m

Balance as per US GAAP

481

Less: Reclassification

(481)

Balance as per IFRS

0

IFRS requires that minority interest be included as part of equity. However, US GAAP requires that it be shown as a line item between liabilities and equity. Since the company has adopted IFRS the financial statements for the prior period also needs to be adjusted in order to both reflect the opening balance for fiscal year 2005/2006 as well as for comparability purposes in accordance with IAS 1. The line item will therefore be deleted from the 2004/2005 financial statements and the figure should therefore be included in equity. This should be stated in the notes to the accounts.

Profit and Loss Elements

Net Sales

€m

€m

Balance as per US GAAP

42,064

Add: IFRS 5 Adjustment

888

42,952

Less: WIP reclassified

8

Embedded Derivatives

17

25

Balance as per IFRS

42,927

Under US GAAP contracts of less than 12 months duration are not dealt with on a percentage-of-completion basis and so they were treated as work in progress. Since IFRS deals with them differently it meant that some of the income relating to these projects for 2004/2005 fiscal year would now be related to the previous year thus the €8m reduction in income under IFRS. IFRS also requires de-recognition of embedded derivatives €17m of and so they have been eliminated from the income statement because they are denominated in a currency that is commonly used in such business transactions.

The €888m that has been added is an adjustment relating to IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations. These disposals were previously recorded as discontinued operations and so they were not included as income. Under IFRS 5 they do not qualify and have therefore been added back.

Selling expenses

€m

€m

Balance as per US GAAP

2,544

Add: IFRS 5 Adjustment

97

4

101

Balance as per IFRS

2,645

Selling expenses of €2,544m was adjusted for €97m under IFRS 5 because the expenses related to disposals that were not included in the income statement previously prepared under US GAAP. Now that the disposal income is included in net sales as explained above the accompanying expenses are also accounted for, some of which affects this account. The €4m relates to net increases and decreases relating to a combination of factors inclusive of the application of the fresh start approach to the opening balance sheet in accordance with IFRS.

Other Operating Income

€m

€m

Balance as per US GAAP

259

Add: IFRS 5 Adjustment

9

Other

8

17

Balance as per IFRS

276

The IFRS 5 adjustment in other operating income resulted from adjustments related to the disposal of aspects of the business operations that were not included in the income statement previously prepared under US GAAP. The increase of €8m resulted from increased gains from disposals as a result of the recognition of impairment charges in the opening balance sheet. These were not recognized under US GAAP.

The overall effects of the changes resulting from ThyssenKrupp’s adoption of IFRS are a reduction in net assets for the 2004/2005 fiscal year and an increase in net income. This has resulted in an improvement in the earnings per share figures in the financial statements for that period. The objective of IFRS 1 which according to IFRS (2011) is to ensure that company’s first IFRS financial statements as well as its interim financial reports contain high quality information that is not only transparent and comparable for all period presented but provides a suitable starting point in accordance with IFRS has been met by ThyssenKrupp.

References

BPP. (2009). F7 Financial Reporting. 3rd ed. London: BPP Learning Media Ltd

Ernst & Young. (2009). International financial reporting developments: IFRS 1 — First-time adoption of International Financial Reporting Standards. Retrieved:

http://www.ey.com/Publication/vwLUAssets/IFRS_1_first-time_adoption_june09/$FILE/IFRS_1_first-time_adoptionJune09_.pdf. Last accessed 16th May 2011

IFRS.org. (2011). Technical Summary. Retrieved: http://www.ifrs.org/NR/rdonlyres/240C0DEC-5C99-4305-8163-B0B9484FE37E/0/IFRS1.pdf. Last accessed 17th May 2011

ThyssenKrupp. (2006) Annual Report 2005-2006 Retrieved: http://www.thyssenkrupp.com/financial-reports/05_06/en/. Last accessed 17th May 2011

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Financial Statements of ThyssenKrupp Group after the Conversion from US GAAP to IFRS"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY