StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Analysis of Xaar Plc

Free

Financial Analysis of Xaar Plc - Report Example

Summary

The paper "Financial Analysis of Xaar Plc" discusses that capital structure analysis shows that debt to equity ratio has declined and funding from equity has increased against liabilities. The reduction in liabilities has also reduced the interest expense of Xaar…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96% of users find it useful

- Subject: Finance & Accounting

- Type: Report

- Level: Ph.D.

- Pages: 5 (1250 words)

- Downloads: 0

- Author: schimmelkeshawn

Extract of sample "Financial Analysis of Xaar Plc"

Financial Analysis of Xaar Plc Introduction Xaar Plc was formed in 1990 and it was listed on London Stock Exchange in 1997 (Xaar, n.d Today it isworld leader in the development and manufacturing of innovative inkjet technologies. The products offered by the company include Inkjet Development System, Printheads and Inks, Hydra Ink Supply System, XUSB Drive Electronics, third party products such as fume extraction systems and other services. The company is operating at global level and it is motivated to offer more products across boarder. The current manufacturing plant is in Sweden and by March 2011, the manufacturing capability of Xaar will be transferred to East of England (Xaar, 2009).

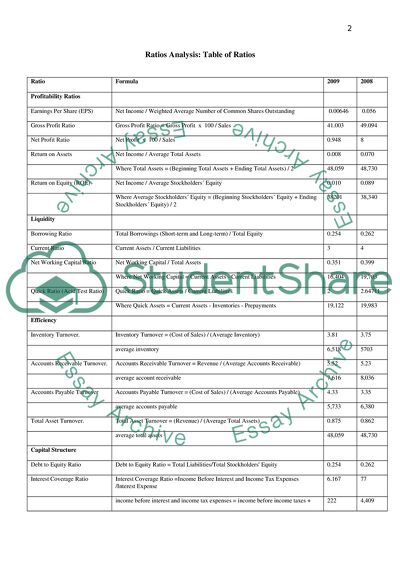

Ratios Analysis: Table of Ratios

Ratio

Formula

2009

2008

Profitability Ratios

Earnings Per Share (EPS)

Net Income / Weighted Average Number of Common Shares Outstanding

0.00646

0.056

Gross Profit Ratio

Gross Profit Ratio = Gross Profit x 100 / Sales

41.003

49.094

Net Profit Ratio

Net Profit x 100 / Sales

0.948

8

Return on Assets

Net Income / Average Total Assets

0.008

0.070

Where Total Assets = (Beginning Total Assets + Ending Total Assets) / 2

48,059

48,730

Return on Equity (ROE)

Net Income / Average Stockholders´ Equity

0.010

0.089

Where Average Stockholders´ Equity = (Beginning Stockholders´ Equity + Ending Stockholders´ Equity) / 2

38201

38,340

Liquidity

Borrowing Ratio

Total Borrowings (Short-term and Long-term) / Total Equity

0.254

0.262

Current Ratio

Current Assets / Current Liabilities

3

4

Net Working Capital Ratio

Net Working Capital / Total Assets

0.351

0.399

Where Net Working Capital = Current Assets - Current Liabilities

16,404

19,703

Quick Ratio (Acid Test Ratio)

Quick Ratio = Quick Assets / Current Liabilities

2

2.64711

Where Quick Assets = Current Assets - Inventories - Prepayments

19,122

19,983

Efficiency

Inventory Turnover.

Inventory Turnover = (Cost of Sales) / (Average Inventory)

3.81

3.75

average inventory

6,518

5703

Accounts Receivable Turnover.

Accounts Receivable Turnover = Revenue / (Average Accounts Receivable)

5.52

5.23

average account receivable

7,616

8,036

Accounts Payable Turnover

Accounts Payable Turnover = (Cost of Sales) / (Average Accounts Payable)

4.33

3.35

average accounts payable

5,733

6,380

Total Asset Turnover.

Total Asset Turnover = (Revenue) / (Average Total Assets)

0.875

0.862

average total assets

48,059

48,730

Capital Structure

Debt to Equity Ratio

Debt to Equity Ratio = Total Liabilities/Total Stockholders Equity

0.254

0.262

Interest Coverage Ratio

Interest Coverage Ratio =Income Before Interest and Income Tax Expenses /Interest Expense

6.167

77

income before interest and income tax expenses = income before income taxes + interest expense

222

4,409

Profitability

Revenues of Xaar have increased by 0.133% in 2009 (£42,071m to £42,073m) however, gross profit has declined from £20628m to £17251m. The net income reported by Xaar in 2009 is £399m as compared to £3431m in 2008. According to Chairman, company remained profitable, cash generative and financially strong in 2009. On the other hand, profitability ratios show a decline from 2008 to 2009 and predict a significant turn down in profitability. Gross profit ratio has declined from 49.094% in 2008 to 41.003 in 2009. As stated by company, decline in gross profit is because of combined effect of reduction in Platform 1 throughput, higher competition in P1 markets and higher costs incurred on new product development (Xaar, 2009). The sales of company declined in China and company expected to regain the lost market shares by launching two new products (Warrier & Kakkrakandy, 2009). Net profit ratio has also declined tremendously from 8% in 2008 to only 0.948% in 2009 because net profit of Xaar has declined from £3431m to £399m. Return on assets has declined from 0.070 to 0.008. The decline in EPS from 5.6p to 0.6p also shows a significant decline in profitability of company. Return on equity has declined from 0.089 in 2008 to 0.010 in 2009. Actually, Xaar generated more revenues in 2009; however, company incurred huge restructuring costs (£553m in 2008 to £2686m in 2009) because of relocation process. Moreover, operating revenue has declined from £3,959m to -£267m because of increased cost of manufacturing and increased administrative expenses. Throughout 2009, company has been showing satisfaction over its level of sales. Xaar Plc showed satisfaction in trading, sales and margins for the third quarter of 2009 (Vargas, 2009).

Liquidity

According to chairman report, in year 2009, Xaar remained very cash generative. It is also evident from net cash flow of £11,521m in 2009 which is slightly lower than £11,601 in 2008. Borrowing ratio has declined from 0.262 to 0.254. Current ratio has declined from 4.0 to 3.0 because of increase in current liabilities from £7,549m to £8,484m and decrease in current assets from £27,252m to £24,888m. Therefore, current assets have declined against current liabilities. Net working capital ratio has reduced from 0.399 in 2008 to 0.351 in 2009. In 2009 the company did not go for long term borrowing and only paid back long term loan installment of the loan taken in 2008. Because of increase in current liabilities, quick ratio has declined from 2.64 to 2.0. The interest cost has been also low (£36m in 2009 and £57m in 2008) because of decline in long term liability. Therefore, strategy of Xaar to reduce liquidity risk by maintaining appropriate cash reserves and by authorising limits on payback periods remained very effective.

Efficiency

Inventory turnover has increased from 3.75 to 3.81, which means that efficiency of management to deplete its inventory has increased. Accounts receivable turnover has increased from 5.23 to 5.52, which means that customers are making payments on time. Accounts payable turnover has also increased from 3.35 to 4.33, which apparently shows that Xaar payable period has increased however, trade payables have declined from £6,031m in 2009 to £5435m in 2008 and increase in turnover is because of increase in cost of goods sold by 16.05%. Total asset turnover has increased from 0.862 to 0.875, which indicates increased efficiency of Xaar to generate sales from assets in 2009 as compared to 2008.

Capital Structure

Debt to equity ratio has declined from 0.262 to 0.254 and it is because of the decline in total liabilities from £10,250£ to £9,466m against the decline in equity from £39,178m to £37,224m. The figures show that because of huge decline in liabilities, financing from equity has increased. Although this increase is not very significant however, it does show a positive sign in capital structure of Xaar. Interestingly, the long term borrowing of Xaar has declined significantly in 2009 because the only long term liability other than deferred tax was sterling loan of £441,000. The interest coverage ratio has largely declined from 77 to 6.167 and it is because of the huge decline in profit before tax from £4,352m in 2008 to -£186m in 2009. The interest cost of Xaar has also reduced because company was liable to pay £36m in 2009 as compared to £48m in 2008 and this year company did not have any interest obligation under finance leases. Since the operating revenue of Xaar was -£267m in 2009 as compared to £3,959m in 2008, therefore, the company paid off interest expenses from other investment income.

Conclusion

Profitability analysis suggests that Xaar has performed will in year 2009 however; company could not appear profitable because of high administration expenses, less profit margins and higher costs. If the company manages to control these costs in future and maintains the current level of revenues, then it may show better performance in the coming years. Liquidly analysis shows that Xaar remained cash generative in 2009 however, current liabilities have increased against current assets but long term borrowing has declined. Efficiency analysis shows that Xaar collection period has reduced, inventory depletion period has reduced and company’s ability to generate sales from assets has also increased. Capital structure analysis shows that debt to equity ratio has declined and funding from equity has increased against liabilities. The reduction in liabilities has also reduced interest expense of Xaar. Therefore, based on ratio analysis, it can be argued that Xaar has been able to generate significant revenues in 2009, however, higher costs and expenses reduced the profitability of company. Moreover, restructuring process further enhanced financial burden of the company, still the company has been successful in increasing efficiency of its operations, maintaining liquidity and reducing financing costs and liabilities.

Bibliography

Vargas (2009) Region’s quoted firms on the up. Accessed 8 August 2010, available at: http://www.businessweekly.co.uk/index.php?option=com_content&view=article&id=35712:regions-quoted-firms-on-the-up&catid=268&Itemid=1620

Warrier, G., & Kakkrakandy, J. (2009) UPDATE 2-Xaars FY profit falls, to shift Swedish plant to UK. Accessed 8 August 2010, available at: http://www.reuters.com/article/idUKBNG37570120090323?type=companyNews

Xaar (2009) Annual Report 2009. London Stock Exchange. Accessed 7 August 2010, available at: https://www.orderannualreports.com/060/UI/GP/results_grid.aspx

Xaar (n.d.) History. Xaar Plc. Accessed 7 August 2010, available at: http://www.xaar.com/history.aspx

Read

More

CHECK THESE SAMPLES OF Financial Analysis of Xaar Plc

The Analysis of the Strategic situation of ARM Holdings

A detailed analysis of ARM.... n the paper, an overall analysis of the different business strategic circumstances especially of ARM Holdings will be taken into concern.... ARM Holdings, which is one of the foremost suppliers of semiconductor products is taken into concern for the study....

8 Pages

(2000 words)

Essay

Analyzing Financial Issues in Cable&Wireless Communications Plc

The use of financial analysis can help a person decipher whether a common stock is a good investment.... This essay "Analyzing Financial Issues in Cable&Wireless Communications plc" will analyze the performance of a company utilizing various analytic tools including ratio analysis, company background, financial performance and investor values, and gearing impact on investment.... The financial performance of the company will be evaluated over five years....

6 Pages

(1500 words)

Essay

Finance and Accounting: Brewin Dolphin Holdings plc

This essay presents Brewin Dolphin Holdings plc which is a company that is based in the United Kingdom and conducts its business in the field of investment management.... As the discussion stresses the primary aim of the company is to provide best financial service to its clients all over the U.... This discussion stresses that Brewin Dolphin Holdings has the second position in the financial sector of the U.... Despite the volatile conditions in the financial sector of the U....

10 Pages

(2500 words)

Essay

Financial Mathematics and Business Statistics

You have been given the following data:Pierce plc has developed two new products (X and Y), both of which require an investment of £5million, the amount of finance the company can raise, which means they can only launch one of them.... "financial Mathematics and Business Statistics" paper discusses and compares the different types of investment appraisal methods Pierce can use, including a discussion of the advantages and disadvantages of each, and makes a recommendation as to which project should be undertaken....

8 Pages

(2000 words)

Assignment

The Largest Service Provider in the UK

Brewin Dolphin Holdings plc is regarded as the most renowned and largest service provider in the UK.... Brewin Dolphin Holdings plc is regarded as the most renowned and largest service provider in the UK.... It aims at delivering discretionary and personalized wealth management services along with investment and financial planning services to the customers in the UK.... It aims at delivering discretionary and personalized wealth management services along with investment and financial planning services....

12 Pages

(3000 words)

Research Proposal

Weighted Average Cost of Capital for LAD TelEQ Plc

The paper "Weighted Average Cost of Capital for LAD TelEQ plc" is a perfect example of a finance and accounting case study.... The paper "Weighted Average Cost of Capital for LAD TelEQ plc" is a perfect example of a finance and accounting case study.... The paper "Weighted Average Cost of Capital for LAD TelEQ plc" is a perfect example of a finance and accounting case study.... eighted Average Cost of Capital (WACC) for LAD TelEQ plc

...

11 Pages

(2750 words)

Case Study

Financial Management & Control - Honeywell Plc Company

The paper "Financial Management & Control - Honeywell plc Company" is a perfect example of a finance and accounting case study.... The paper "Financial Management & Control - Honeywell plc Company" is a perfect example of a finance and accounting case study.... The paper "Financial Management & Control - Honeywell plc Company" is a perfect example of a finance and accounting case study.... Therefore, it means that the profits which are generated by Honeywell plc Company, by comparing net operating profit to capital employed has led to the following increase in the ROCE experienced (Raheman 2007 p....

13 Pages

(3250 words)

Case Study

Financial Analysis of Oxford Instruments PLC

The paper 'financial analysis of Oxford Instruments PLC ' is a thrilling variant of a case study on finance & accounting.... The paper 'financial analysis of Oxford Instruments PLC ' is a thrilling variant of a case study on finance & accounting.... The paper 'financial analysis of Oxford Instruments PLC ' is a thrilling variant of a case study on finance & accounting.... In light of this statement, this report presents a detailed analysis and evaluation of Oxford Instruments plc's performance....

11 Pages

(2750 words)

Case Study

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"Financial Analysis of Xaar Plc"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY