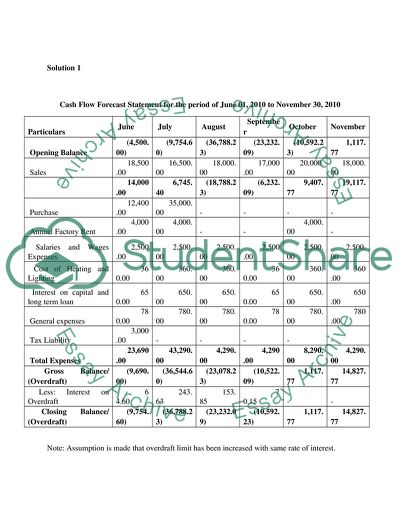

Cash Flow Forecast Statement in Hidetoseek Ltd Assignment - 5. https://studentshare.org/finance-accounting/1739731-introduction-to-accounting-and-finance-economics-finance-and-management

Cash Flow Forecast Statement in Hidetoseek Ltd Assignment - 5. https://studentshare.org/finance-accounting/1739731-introduction-to-accounting-and-finance-economics-finance-and-management.