StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Accounting Project

Free

Accounting Project - Report Example

Summary

This paper 'Accounting Project' tells that The companies chosen for this study include Best Buy Incorporated, Hewlett Packard, and United Parcel Service. Best Buy and Hewlett Packard are product-oriented companies whereas United Parcel Service of America is a service-oriented business…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER95.1% of users find it useful

- Subject: Finance & Accounting

- Type: Report

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: ethyl50

Extract of sample "Accounting Project"

Accounting Project The companies chosen for this study include, Best Buy Incorporated, Hewlett Packard and United Parcel Service. Best Buy and Hewlett Packard are product oriented companies whereas United Parcel Service of America is a service oriented business. These are publicly traded companies in the New York Stock Exchange (NYSE). The latest annual reports of these companies are taken and analysed in the following sections.

Best Buy Incorporated:

Best Buy Incorporated deals with consumer electronics and has a huge customer base. As the name indicates, Best Buy focuses on providing customers with electronic products at affordable prices and of high quality. The company trades in NYSE (company code: BBY). The Annual Report of the company in 2009 is examined to analyze the financial position and performance of Best Buy.

Financial Analysis:

The current assets and the current liabilities of Best Buy are analyzed to identify the liquidity position of the company (Best Buy).

Best Buy Inc. (2009)

Current Assets (CA)

$8,192,000

Current Liabilities (CL)

$8,435,000

Current Ratio (CA / CL)

0.97

The current ratio is slightly lesser than 1 and this is financially not healthy for Best Buy. The ratio of current assets to current liabilities indicates the ability of the company to meet its immediate obligations. It is evident that the liquidity position of Best Buy is not ideal (MSN Money).

The net cash flow from investing activities of Best Buy ($ 3,573,000) indicates that the company has actively involved in investment activities in the previous year. This is also reflected in the Non Current Assets section of the company’s Balance Sheet which shows an increase of about $ 3,068,000 in the year 2009 (Form10-K).

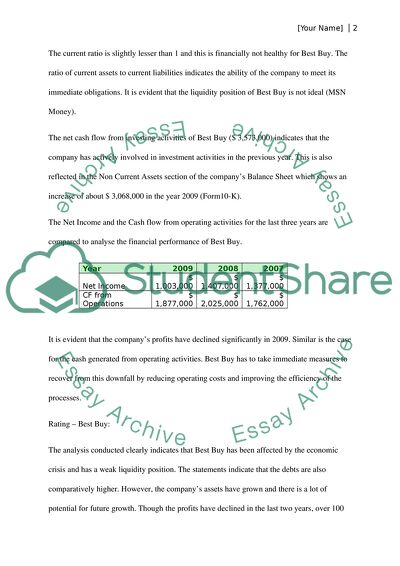

The Net Income and the Cash flow from operating activities for the last three years are compared to analyse the financial performance of Best Buy.

Year

2009

2008

2007

Net Income

$ 1,003,000

$ 1,407,000

$ 1,377,000

CF from Operations

$ 1,877,000

$ 2,025,000

$ 1,762,000

It is evident that the company’s profits have declined significantly in 2009. Similar is the case for the cash generated from operating activities. Best Buy has to take immediate measures to recover from this downfall by reducing operating costs and improving the efficiency of the processes.

Rating – Best Buy:

The analysis conducted clearly indicates that Best Buy has been affected by the economic crisis and has a weak liquidity position. The statements indicate that the debts are also comparatively higher. However, the company’s assets have grown and there is a lot of potential for future growth. Though the profits have declined in the last two years, over 100 stores were opened by Best Buy worldwide in the years 2008 and 2009. The increase in the number of stores, acquisition of major bodies such as Best Buy Europe, Five Star, etc indicate high earning capacity in the future. Hence, I would give Grade B to the company’s President.

Hewlett Packard:

Hewlett Packard is one of the leading computer hardware manufacturers operating across the globe. The main products of Hewlett Packard include Personal Computers, Laptops, Printers, Scanners and other utilities. The company also develops the software necessary for running its products such as the printers, scanners, webcams, etc (HP.com). The company’s code is HPQ in the NYSE. The statements used for this analysis include the income statements, balance sheets and cash flow statements of the Annual Report for the year ending on 31st of October, 2008.

Financial Analysis:

The liquidity position of Hewlett Packard is analysed from the statements and it is identified that the company has a similar current ratio as that of Best Buy.

Hewlett Packard (2008)

Current Assets (CA)

$ 51,728,000

Current Liabilities (CL)

$ 52,939,000

Current Ratio (CA / CL)

0.98

The company has also registered about $ 13.7 million in cash flow involved in investing activities, the highest over the three year period. Also, there is a significant increase ($ 15 million) in the assets of HP indicating the company’s strong position (HP).

It is imperative to note that HP, in addition to investing in long term assets, has also recorded high profits, as shown in the table below.

There is a steady growth in the net income over the three years in spite of the global economic crisis. The cash flow from operating activities also exhibits a rising trend indicating the high quality of income (2008-Annual Report).

Rating – HP:

The Chief Executive Officer of Hewlett Packard indicates in the 2008 Annual Report that the company has performed exceptionally well in the current global economic slowdown. He also highlights that the acquisition of Electronic Data Systems (EDS) has been completed and the integration process is smooth and ahead of the schedule. HP has registered a revenue growth of 13 % to $ 118.4 billion when compared to the previous year (2008-AnnualReport). The company’s profits are significant and the liquidity position is of little concern as major investment activities have been recorded recently. Hence, the company’s President will definitely receive a Grade A.

United Parcel Service (UPS):

United Parcel Service is majorly a package delivery company which also provides transportation, logistics and financial services. The company is based out of United States and operates internationally in over 200 countries and territories. The three main segments that UPS operates within include U.S. Domestic Package, International Package and Supply Chain & freight (UPS - About Us). The company delivers as many as 15 million packages worldwide. The company trades on the NYSE and the company trades under the symbol UPS.

Financial Analysis:

UPS has the strongest liquidity position of the three companies. The current ratio is computed as shown below:

UPS (2008)

Current Assets (CA)

$8,845,000

Current Liabilities (CL)

$7,817,000

Current Ratio (CA / CL)

1.13

It is evident that the company will be able to cover all its current liabilities with the current assets, as the current ratio is higher than 1.

The assets of UPS have decreased in the year 2008 ($ 31.88 million) when compared to the previous year ($ 39.04 million). The cash flow from investing activities shows no substantial change. Hence it is evident that the company has not involved in any major investing activities (UPS).

The net income, however, has shown a substantial increase in 2008, but still lesser than that of the year 2006 (UPS). The discrepancy in 2007 can be attributed to the economic crisis as well as some investing activities undertook by UPS. The cash flow position has increased significantly indicating a high quality of income.

Year

2008

2007

2006

Net Income

$3,003,000

$382,000

$4,202,000

CF from Operations

$8,426,000

$1,123,000

$5,589,000

Rating – UPS:

Based on the analysis, the President of UPS can be given a rating of Grade B. Though there is a rise in the income and cash flow (UPS), the company has not sustained itself in the economic crisis and has not geared itself for future growth by investing in assets.

Summary:

Thus the three companies, Best Buy, Hewlett Packard and United Parcel Service are financially analysed. The Presidents of these companies are also given ratings based on the financial performance of the company.

Works Cited

2008-AnnualReport. 2008 Annual Report. 2008. 16 January 2010.

Best Buy. Financials & Store Count Information. 2010. 16 January 2010 .

HP.com. Hewlett Packard. 2009. 16 January 2010 .

MSN Money. Best BUY Co Inc: Financial Statement. 2010. 17 January 2010 .

Form10-K. Annual Report. 28 2 2009. 17 January 2010 .

UPS - About Us. Corporate Profile. 2010. 17 January 2010 .

UPS. UPS Investor relations. 2010. 17 January 2010 .

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the report on your topic

"Accounting Project"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY