StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Payments and Financing Activities

Free

Payments and Financing Activities - Coursework Example

Summary

This essay discusses that with regard to bank overdraft facilities, the bank is mainly concerned with Current Ratio, Quick Ratio, inventory turnover, and asset turnover of Park Leisurewear Ltd. (PL). Liquidity of an entity is established by its current ratio…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER92% of users find it useful

- Subject: Finance & Accounting

- Type: Coursework

- Level: Ph.D.

- Pages: 5 (1250 words)

- Downloads: 0

- Author: ryannwilkinson

Extract of sample "Payments and Financing Activities"

Payments and Financing Activities

2007

2008

Return on equity (aka return on shareholders’ funds) % (calculate to one decimal place)

Earning available to common shareholders

----------------------------------------------------------- %

Common Stock Equity

The return on equity measures the profitability of equity funds invested in a firm. It reflects the productivity of ownership (or risk) capital employed in the firm. In 2008 PL has tremendously improved its return on equity as compared to 2007 and this is highly commendable.

18.2%

32.5%

Dividend payout ratio % (calculate to one decimal place)

Dividend payout ratio is the percentage of firm’s earnings that are distributed among shareholders in form of cash. It affects the market price of company’s shares. Constant dividend payout ratio establishes the creditability of firm among investors. In 2008 this ratio has declined in case of PL from 48.1% in 2007 to 27.3% in 2008 and this may have an effect on the marketability of PL’s shares. This ratio is calculated as under

Dividend Per Share

--------------------------- %

Earning Per Share

48.1%

27.3%

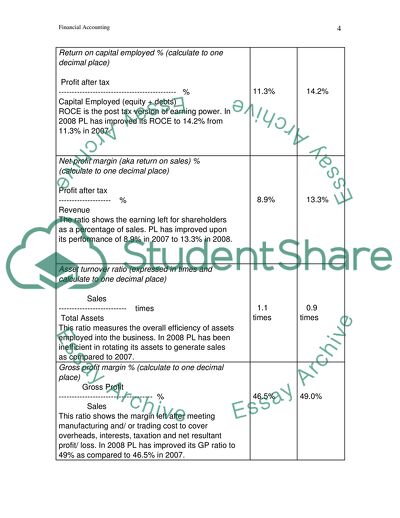

Return on capital employed % (calculate to one decimal place)

Profit after tax

--------------------------------------------- %

Capital Employed (equity + debts)

ROCE is the post tax version of earning power. In 2008 PL has improved its ROCE to 14.2% from 11.3% in 2007.

11.3%

14.2%

Net profit margin (aka return on sales) % (calculate to one decimal place)

Profit after tax

-------------------- %

Revenue

The ratio shows the earning left for shareholders as a percentage of sales. PL has improved upon its performance of 8.9% in 2007 to 13.3% in 2008.

8.9%

13.3%

Asset turnover ratio (expressed in times and calculate to one decimal place)

Sales

-------------------------- times

Total Assets

This ratio measures the overall efficiency of assets employed into the business. In 2008 PL has been inefficient in rotating its assets to generate sales as compared to 2007.

1.1 times

0.9 times

Gross profit margin % (calculate to one decimal place)

Gross Profit

------------------------------------ %

Sales

This ratio shows the margin left after meeting manufacturing and/ or trading cost to cover overheads, interests, taxation and net resultant profit/ loss. In 2008 PL has improved its GP ratio to 49% as compared to 46.5% in 2007.

46.5%

49.0%

Inventory turn in days (round up to the nearest day)

365

---------------------------------------- days

Cost of Goods Sold / Inventory

This ratio reflects the efficiency of inventory management. The higher the ratio(less number of days) the more efficient the management of inventories. In 2008 PL has less efficient management of inventory as it held stock for more number of days as compared to 2007.

118 days

183 days

Receivables collection period in days (round up to the nearest day)

Accounts Receivable

----------------------------- days

Sales / 365

It represents the number of days’ worth of credit sales that is locked in sundry debtors. The lower the number of days the better it is. In 2008 credit period of collection has increased and thus shows the inefficiency of PL.

42 days

61 days

Trade payables collection period in days (round up to the nearest day) – assume account purchases of inventory in each year amounted to £15,030,000

Assets Payable

---------------------- days

15,30,000 / 365

This represents the number days available to PL for making payment for credit purchases. Here PL has improved the credit period from 29 days in 2007 to 63 days in 2008. In fact effectiveness of average collection period of sales and average payment period of purchases can be judged only with reference to overall credit policy of the company. Here PL has countered the increase in average collection period with increase in average payment period.

29 days

63 days

Current ratio (calculate to one decimal place)

Current Assets

--------------------

Current Liabilities

Current Ratio measures the ability of the firm to meet its short term obligations. It assesses the liquidity of the firm. The general norm internationally is 2:1. PL has current ratio lower than the standard in both the years, and hence may face liquidity problems in meeting its short term obligations.

1.8 : 1

1.1 : 1

Quick assets (or acid test) ratio (calculate to one decimal place)

Current Assets - Inventory

-----------------------------------

Current Liabilities

It is defined as current ratio excluding inventories, and the required standard is 1:1. Quick assets ratio is rather stringent measure of liquidity. PL has this ratio below the required standard in both years, and may face liquidity crunch in meeting its short term liabilities.

0.8 : 1

0.5 : 1

Gearing (calculate to one decimal place)

Total Liabilities

------------------------- %

Total Assets

It is a leverage ratio that assesses how the assets of the company have been financed. In 2008 63.2% of total assets of PL have been financed through debt capital, and hence PL may be called a highly geared company.

46.9 %

63.2 %

OTHER COMMENTS AS APPROPRIATE

With regard to bank overdraft facilities, the bank is mainly concerned with Current Ratio, Quick Ratio, inventory turnover, and asset turnover of Park Leisurewear Ltd. (PL). Liquidity of an entity is established by its current ratio. Current ratio and quick ratio determine the short term solvency of the company. A company is considered short term solvent when it is able to meet its short term obligations when those become due. The optimum current ratio and quick ratio of any entity is considered 2:1 and 1:1 respectively. In case of PL current ratio in 2007 was 1.8:1 and 1.1:1 respectively. Similarly the quick ratio for 2007 and 2008 was 0.8 and 0.5 respectively. Both current and quick ratio were less than the optimum standard fixed for any industry in 2007 and those further went down in 2008. It seems that PL is facing the real liquidity crunch, and it may face difficulties in meeting its short term obligations. In fact PL made an investment of $8670000 in non- current assets. Because of this investment the liquidity required for working capital further tightened in 2008 and with the result both ratios came down. With the result bank is doubtful about the PL meeting its short term obligations on due

dates.

It is true that turnover and profitability of the company has improved tremendously in 2008 as compared to 2007, but these results have been attained in an inefficient manner. The bank is concerned with decreasing Inventory turnover and asset turnover ratios. ‘Inventory turnover commonly measures the activity, liquidity of a firm’s inventory.’(Lawrence J Gitman, page 60)1 It has gone down from 118 days in 2007 to 183 days in 2008. Similarly ‘the total asset turnover indicates the efficiency with which the firm uses its assets to generate sales.’(Lawrence J Gitman, page 60)2 .This has also gone down from 1.1 time to 0.9 times. Further credit collection period has increased from 42 days to 61 days. Though credit payment period have also gone up but overall credit period has increased and this shows the inefficiency in operations of the PL.

Above all gearing ratio that reflects the pattern of financing assets of the company has also been greatly disturbed. Earlier 46.9% of assets were financed through debt capital but in 2008 63.2% of assets have been financed by debt capital. This certainly is also a cause of concern for the bank.

In order to attain the favor from bank, the company has to improve its efficiency in its operations, improve liquidity, and capital gearing.

References:

Lawrence J Gitman, Principles of Managerial Finance, Eleventh Edition, Pearson Education, page 60

2 ibid, page 60

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the coursework on your topic

"Payments and Financing Activities"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY