StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Accounting Exam

Free

Accounting Exam - Assignment Example

Summary

The assignment "Accounting Exam" covers various accounting problems studied throughout an accounting course. …

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER92.5% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: jacobszella

Extract of sample "Accounting Exam"

Week Five Exam BE 1; Page 32 Match the following forms of business organization with a set of characteristics: Sole Proprietorship(SP), Partnership(P), Corporation (C)

(a) Partnership(P) - Shared control, tax advantages, increased skills and resources.

(b) Sole Proprietorship (SP) - Simple to set up and maintains control with founder.

(c) Corporation (C) - Easier to transfer ownership and raise funds, no personal liability.

BE-1-3; Page 32

Indicate in which part of the statement of cash flows each item would appear:

Operating activities(O), Investing activities (I), or Financing activities (F).

(a) Operating activities(O) - cash received from customers.

(b) Financing activities (F) - cash paid to stockholders (dividends).

(c) Financing activities (F) - cash received from issuing new common stock.

(d) Operating activities(O) - cash paid to suppliers.

(e) Investing activities (I) - cash paid to purchase a new office building.

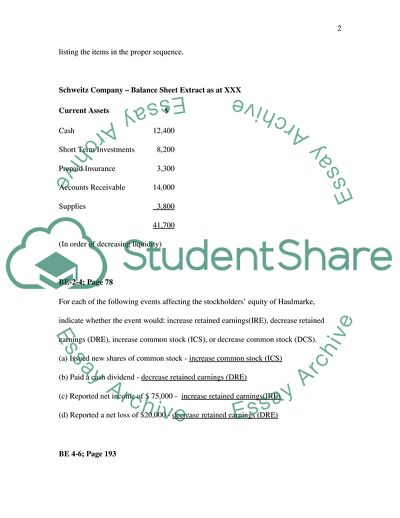

BE-2-2; Page 78

A list of financial statement items for Schweitz Company includes the following: accounts receivable $14,000; prepaid insurance $3,300; cash $12,400; supplies $3,800, and short-term investments $8,200. Prepare the current assets section of the balance sheet listing the items in the proper sequence.

Schweitz Company – Balance Sheet Extract as at XXX

Current Assets $

Cash 12,400

Short Term Investments 8,200

Prepaid Insurance 3,300

Accounts Receivable 14,000

Supplies 3,800

41,700

(In order of decreasing liquidity)

BE-2-4; Page 78

For each of the following events affecting the stockholders’ equity of Haulmarke, indicate whether the event would: increase retained earnings(IRE), decrease retained earnings (DRE), increase common stock (ICS), or decrease common stock (DCS).

(a) Issued new shares of common stock - increase common stock (ICS)

(b) Paid a cash dividend - decrease retained earnings (DRE)

(c) Reported net income of $ 75,000 - increase retained earnings(IRE)

(d) Reported a net loss of $20,000 - decrease retained earnings (DRE)

BE 4-6; Page 193

On July 1, 2007 Lumas Co. pays $14,800 to Patel Insurance Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. For Lumas Co. journalize and post the entry on July 1 and the adjusting entry on December 31.

Lumas Co. - Journal Entries $ $

July 1 Patel Insurance Debit 14,800

Cash/Bank Account Credit 14,800

(Accounting for the insurance expense paid)

Dec 31 Income Statement Debit 3,700

Patel Insurance Credit 3,700

(Charging the insurance expense for the year to the Income Statement)

(Workings: Insurance expense for the year is 6/24 x 14800=3,700)

Cash / Bank Account [extract]

1 July Patel Insurance

14,800

Patel Insurance Account

1 July Cash/ Bank

1 Jan Bal b/d (i.e prepaid insurance)

14,800

_____

14,800

11,100

31 Dec Income Statement

31 Dec Balance c/d

3,700

11,100

14,800

BE 4-8; Page 193

The bookkeeper for Ahlet Company asks you to prepare the following accrual adjusting entries at December 31.

(a) Interest on notes payable of $400 is accrued.

(b) Service revenue earned but unbilled total $1,400

(c) Salaries of $780 earned by employees have not been recorded.

Use the account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries Expense, and Salaries Payable

Ahlet Co. - Journal Entries $ $

31 Dec Interest Expense Debit 400

Interest Payable Credit 400 (Adjusting for accrued interest on notes payable)

Accounts Receivable Debit 1400

Service Revenue Credit 1400

(Adjusting for unbilled service revenue)

Salaries Expense Debit 780

Salaries Payable Credit 780

(Adjusting for unrecorded salaries)

BE 7-1; Page 348

Jo Duma is the new owner of JoJo Co. She has heard about internal control but is not clear about the importance for her business. Explain to Jo the two purposes of internal control, and give her one application of each purpose for JoJo Co.

Internal control is important for a number of reasons which can be broadly distilled into two main purposes. The first is “external” or outward looking in that internal controls ensure the quality (accuracy, reliability etc.) of the reporting procedures of the Company. The presence of internal controls give outsiders confidence in the reported state of the company’s affairs, be it published accounts used by the shareholders of public companies or even management accounts of smaller companied used by, for example, banks and tax authorities. The other purpose is more inward looking. Internal controls ensure that a company attains its organizational goals. As put in the Financial Reporting Council of UK’s guidance on Internal Control, internal controls facilitate the effective and efficient operation of a business by enabling it to respond to significant risks, including the proper management of assets and liabilities (7).

An application of the first purpose of ensuring the quality of the Company’s reporting would be the conducting of reconciliations between, for example, the individual debtor’s accounts and the accounts receivable control account to ensure that no mistakes were made during posting. An application of the second purpose would be the physical safeguard of corporate assets to protect them from theft, natural disasters etc. Without such assets the Company may not be able to continue their operations.

BE 7-8; Page 349

At July 31 Ballah Company has this bank information: cash balance per bank $7,800; outstanding checks $762; deposits in transit $1,350; and a service charge $40. Determine the adjusted cash balance per bank at July 31.

Cash Balance as per Bank – July 31 $7,800

Add: Deposits in Transit $1,350

Less: Outstanding Checks $762

Service Charge $40 ($802)

Adjusted Cash Balance per Bank – July 31 $8,348

BE 13-2; Page 684

An inexperienced accountant for Barlay Corporation showed the following in Barlay’s 2007 income statement: Income before taxes $300,000; Income tax expense $48,000; Extraordinary loss from flood (before taxes) $60,000; and Net income $192,000. The extraordinary loss and taxable income are both subject to a 20% tax rate. Prepare a correct income statement beginning with “Income before income taxes.”

Barlay Corporation- Extract from Income Statement for the year ended XX 2007

$ $

Income before income taxes 300,000

Income tax expense

Tax expense on income (20% x 300,000) 60,000

Tax credit on extraordinary loss (20% x 60,000) (12,000) (48,000)

Income before extraordinary loss 252,000

Extraordinary loss from flood (net of 12,000 tax credit) (48,000)

Net Income 204,000

BE 13-11; Page 685

The following data are taken from the financial statements of Tall Tail Company.

2007 2006

Accounts Receivable (net), end of year $560,000 $540,000

Net sales on account $4,700,000 $4,000,000

Terms of all sales are 1/10, n/45

Compute for each year (a) the receivables turnover ratio and (b) the average collection period. What conclusions about the management of accounts receivable can be drawn from these data? At the end of 2005, accounts receivable was $500,000.

2007 2006

(a) Accounts receivable turnover ratio: 4,700/560 4,000/540

( = Sales/year end accounts receivable) =8.4 times =7.4 times

(b) Average Collection Period:

(=Average accounts receivable/sales x 365) 550/4700x365 520/4000x365

=42.7 days =47.45 days

The Accounts Receivable Turnover Ratio (ARTR) refers to the frequency or number of times the accounts receivable balance has been paid and reestablished for the relevant accounting year. The higher it is the better, as it means the Company is able to collect its debts fast and as such has more cash at hand. i.e. it is in a better position in terms of liquidity. The ratio has improved from 2006 to 2007, showing that Tall Tail has become more efficient in collecting debts and converting receivables to cash.

The Average Collection Period (ACP) refers to the number of days it takes for a debtor to repay its debt to Tall Tail. The lower it is the better as it means the Company is able to recover its debts more quickly. The ACP has marginally decreased from 2006 to 2007 by about 5 days, which means that the Company debtors are paying back their debts 5 days sooner in 2007 than they did in 2006.

Tall Tail uses sales terms of 1/10, n/45 meaning 1% discount is given if the invoice is paid in 10 days and the net invoice total is due in 45 days. In 2006, on average, the Company’s debtors were not adhering to the credit terms and did not seem to take advantage of the discount for early settlement. On the contrary, in 2007, on average the debtors settled their accounts inside the credit limits and this maybe a sign of more debtors taking advantage of the sales discount.

Works Cited

United Kingdom. Financial Reporting Council. Internal Control – Revised Guidance for Directors on the Combined Code. London, 2005.

Read

More

CHECK THESE SAMPLES OF Accounting Exam

Differences between Operating and Financial Synergy

The paper "Differences between Operating and Financial Synergy" states that companies need to complete the transition and integration process quickly because it will help prevent employee turnover, prevent the losses of productivity limit the amount of profit impact during that time nominal.... ... ...

3 Pages

(750 words)

Essay

Qualifications to become an accountant in the UK

Graduates have the option of joining a specialised accountancy firm or working for a general organisation in need of accounting services.... The accounting sector has revolutionised from what it was some decades ago.... Gone are the days when accounting was thought to be something that involved numbers only.... For the points required to enter this accounting qualification; candidates must have a minimum of two hundred and twenty tariff points in UCAS or in general, they can have eighteen points....

10 Pages

(2500 words)

Case Study

Exam Habits

One area that the parents and the guardians fail is not telling thee children how specifically; they are to study hard and in the end pass their exams.... It has therefore,.... ... ... Schools today, provide different challenges to certain students while others it is an easy task.... This point out an aspect that deed, both the parents and the teachers have a desire for students to perform well, however, they provide little guidance on determining the most appropriate learning techniques that would work to enhance educational outcomes (Barrass, 2002)....

4 Pages

(1000 words)

Research Paper

Motivation Can Be Labeled as a Process That Acts as a Catalyst to Help Someone

For example, you can say that Sarah was so motivated to clear her Accounting Exam that she studied late at night to achieve her respective goals.... The paper "Motivation Can Be Labeled as a Process That Acts as a Catalyst to Help Someone" states that behavior exhibits motivation....

4 Pages

(1000 words)

Essay

The Job Specifics of Certified Professional Accountants

To be a CPA one need to pass the exam of CPA and also have to fulfill the practical training requirements before one can actually start using the word CPA after his or her name.... Historically exam was offered in a pen and paper-based environment, however, it was subsequently changed and an exam is now conducted on computers.... There are further changes in the way exam will take place from next year, therefore, the overall challenges to pass the exam are increasing and the candidates will have to sort some important challenges in order to become successful in this exam....

5 Pages

(1250 words)

Research Paper

Chartered Accountant - Career and Job Analysis

Undertaking an exam with any one of these bodies and having relevant work experience is what is required for a chartered accountant.... Depending on the exam body chosen, the timing for the accounting studies varies.... The paper 'Chartered Accountant - Career and Job Analysis' is an inspiring example of a finance & accounting resume.... The career of my choice is accounting.... The paper 'Chartered Accountant - Career and Job Analysis' is an inspiring example of a finance & accounting resume....

8 Pages

(2000 words)

Resume/CV

Does Ethics Get Enough Attention in Accounting Education

The paper 'Does Ethics Get Enough Attention in accounting Education?... is a provoking example of a finance & accounting research proposal.... accounting refers to a body and practice of knowledge that is concerned with systematic recording, reporting, and analysis of financial transactions of a firm (Greenfield, 2004).... The paper 'Does Ethics Get Enough Attention in accounting Education?... is a provoking example of a finance & accounting research proposal....

17 Pages

(4250 words)

Research Proposal

Analysis of CPA and ICAA Accounting Bodies and Their Membership Benefits to a Student

The paper 'Analysis of CPA and ICAA accounting Bodies and Their Membership Benefits to a Student' is a thrilling example of a finance & accounting case study.... A student in Australia is presented with 3 options when it comes to joining an accounting body.... The paper 'Analysis of CPA and ICAA accounting Bodies and Their Membership Benefits to a Student' is a thrilling example of a finance & accounting case study....

7 Pages

(1750 words)

Case Study

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Accounting Exam"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY