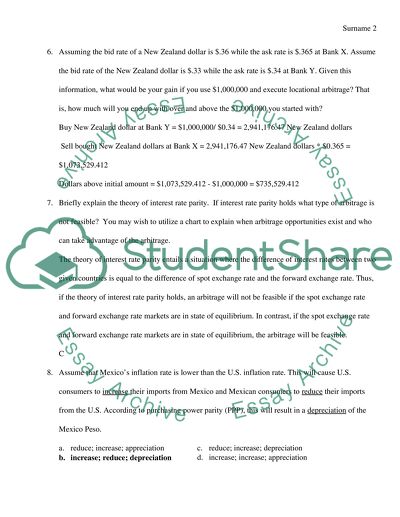

International Financial Management final Assignment. Retrieved from https://studentshare.org/finance-accounting/1699255-international-financial-management-final

International Financial Management Final Assignment. https://studentshare.org/finance-accounting/1699255-international-financial-management-final.