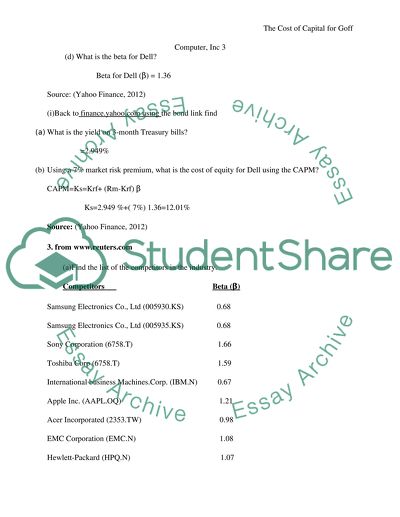

The Cost of Capital for Goff Computer, Inc Assignment. Retrieved from https://studentshare.org/finance-accounting/1611559-the-cost-of-capital-for-goff-computer-inc

The Cost of Capital for Goff Computer, Inc Assignment. https://studentshare.org/finance-accounting/1611559-the-cost-of-capital-for-goff-computer-inc.