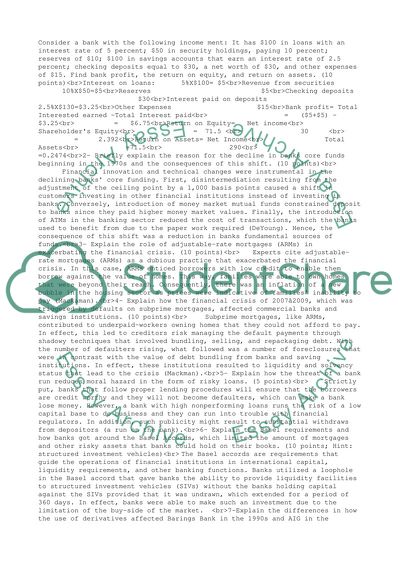

Money and banking Assignment Example | Topics and Well Written Essays - 500 words. Retrieved from https://studentshare.org/business/1609127-money-and-banking

Money and Banking Assignment Example | Topics and Well Written Essays - 500 Words. https://studentshare.org/business/1609127-money-and-banking.