StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Walmart - Difference between Net Income and Net Cash Flow

Free

Walmart - Difference between Net Income and Net Cash Flow - Example

Summary

This means that it is probably in a much better financial position compared to Walmart.From the above figures it is clear that Target has managed its…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER91.9% of users find it useful

- Subject: Finance & Accounting

- Type:

- Level: College

- Pages: 4 (1000 words)

- Downloads: 0

- Author: quitzonmargaret

Extract of sample "Walmart - Difference between Net Income and Net Cash Flow"

al Affiliation) FINANCE AND ACCOUNTING Task 3 (a) Cash flow from operating activities (millions of Dollars)

2013

Target

5,881

5,271

5,434

5,235

Walmart

23,643

24,255

25,591

23,257

As reflected in the above table, compared to Walmart, Target has had much higher cash flows over the past 4 financial years. This means that it is probably in a much better financial position compared to Walmart.

b)

Current assets (millions of Dollars)

2010

2011

2012

2013

Target

18,424

17,213

16,449

16,388

Walmart

52,012

54,975

59,940

61,185

Current liabilities (millions of Dollars)

2010

2011

2012

2013

Target

11,327

10,070

14,287

14,031

Walmart

58,603

62,300

71,818

69,345

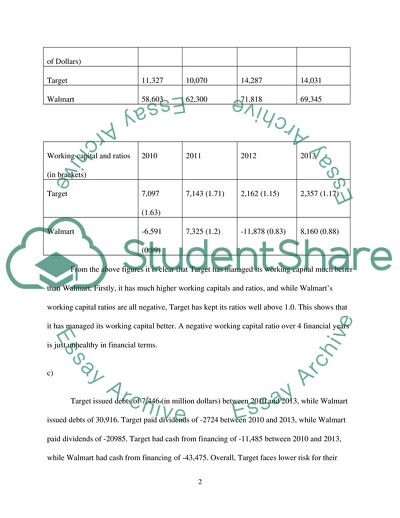

Working capital and ratios (in brackets)

2010

2011

2012

2013

Target

7,097 (1.63)

7,143 (1.71)

2,162 (1.15)

2,357 (1.17)

Walmart

-6,591 (0.89)

7,325 (1.2)

-11,878 (0.83)

8,160 (0.88)

From the above figures it is clear that Target has managed its working capital much better than Walmart. Firstly, it has much higher working capitals and ratios, and while Walmart’s working capital ratios are all negative, Target has kept its ratios well above 1.0. This shows that it has managed its working capital better. A negative working capital ratio over 4 financial years is just unhealthy in financial terms.

c)

Target issued debts of 7,446 (in million dollars) between 2010 and 2013, while Walmart issued debts of 30,916. Target paid dividends of -2724 between 2010 and 2013, while Walmart paid dividends of -20985. Target had cash from financing of -11,485 between 2010 and 2013, while Walmart had cash from financing of -43,475. Overall, Target faces lower risk for their long-term funding policy in the most recent year. This is because it has much more cash from its financing activities compared to Walmart. This shows that it has a greater earning power and more liquidity than Walmart. As a result, it is able to implement its long-term funding policy while incurring much lower risks.

d)

Target issued debts of 7,446 between 2010 and 2013, while Walmart issued debts of 30,916. Based on this evidence, Target had a more prudent investment policy in the most recent financial year. This is because it borrowed less as compared to Walmart. Walmart may be generating more cash flow than Target, but Target has less debt, meaning it is faced with less risk going forward. More often than not, income is not the sole indicator of a business’s good performance. Debt is equally significant.

Task 4

Target has adopted a plan of minimizing cash outflows as much as possible, while maintaining a steady cash inflow. On the other hand, Walmart has adopted a plan of ensuring high cash inflows, while maintaining a steady cash outflow. In summary, it is clear that Walmart is focused on growth and expansion despite conditions like debt, while Target leans towards steady expansion and growth that comes with less debt accumulation and risk going forward. Walmart is acutely focused on revenue generation and entering more markets, but Target is able to manage its cash flow better. This is due to the fact that it commands much higher working capitals, and working capital ratios. These are closely related to how it manages its cash flows.

Conclusion

The difference between net income and net cash flow is as clear as day, but not to everybody. People conversant with business principles and practices may be, but most small business owners are not. They should go out of their way to understand the two concepts because it saves valuable time and money in the end. The teaching of business in learning institutions should be approached from the practical perspective of business owners, rather than the theoretical and sometimes confusing view of scholars. Finally, Target’s financial status is much healthier than Walmart’s. Target’s growth may be slower compared to Walmart’s, but the amount of debt Walmart has makes its growth meaningless. It can generate as much revenue as it wishes, but the debt will scare away future potential investors. Target makes more sense from a holistic business perspective, but Walmart is only commercially attractive, with a bleak long-term outlook.

References

Elliott, B., & Elliott, J. 2008, Financial accounting and reporting, 12th ed, Harlow: Financial

Times Prentice Hall.

http://www.bloomberg.com/

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the on your topic

"Walmart - Difference between Net Income and Net Cash Flow"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY