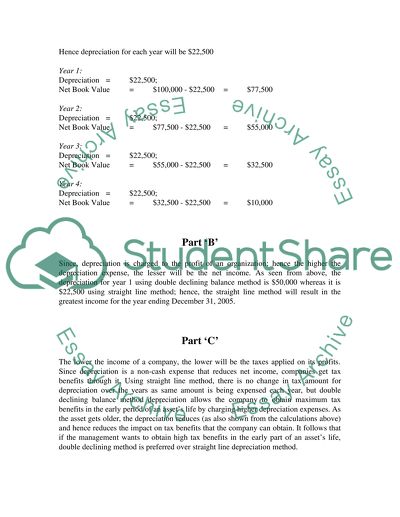

Assignment on Financial Accounting Research Paper. Retrieved from https://studentshare.org/miscellaneous/1512734-assignment-on-financial-accounting

Assignment on Financial Accounting Research Paper. https://studentshare.org/miscellaneous/1512734-assignment-on-financial-accounting.