StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Performance Analysis

Free

Financial Performance Analysis - Case Study Example

Summary

The study "Financial Performance Analysis" focuses on the critical financial analysis of a company and aid in decision making. The revenues of the company have been on the rise but the problem with the company is in the ever-rising costs of goods sold…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER98.1% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: bernard20

Extract of sample "Financial Performance Analysis"

Contents Contents Financial ment Analysis 2 Operating Expense Analysis 2 Possible reasons for the Rising Cost 3 Analysis 4 Balance Sheet Analysis 5

6

Conclusion 6

Financial Statement Analysis

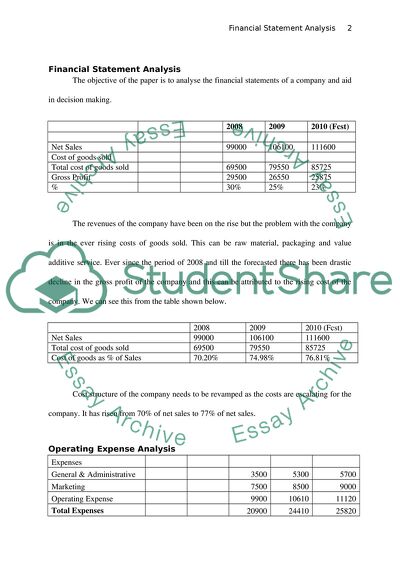

The objective of the paper is to analyse the financial statements of a company and aid in decision making.

2008

2009

2010 (Fcst)

Net Sales

99000

106100

111600

Cost of goods sold

Total cost of goods sold

69500

79550

85725

Gross Profit

29500

26550

25875

%

30%

25%

23%

The revenues of the company have been on the rise but the problem with the company is in the ever rising costs of goods sold. This can be raw material, packaging and value additive service. Ever since the period of 2008 and till the forecasted there has been drastic decline in the gross profit of the company and this can be attributed to the rising cost of the company. We can see this from the table shown below.

2008

2009

2010 (Fcst)

Net Sales

99000

106100

111600

Total cost of goods sold

69500

79550

85725

Cost of goods as % of Sales

70.20%

74.98%

76.81%

Cost structure of the company needs to be revamped as the costs are escalating for the company. It has risen from 70% of net sales to 77% of net sales.

Operating Expense Analysis

Expenses

General & Administrative

3500

5300

5700

Marketing

7500

8500

9000

Operating Expense

9900

10610

11120

Total Expenses

20900

24410

25820

All the major operating expense has risen over the concerned period as a result of which the company is facing huge problems at operating level profitability. This is one of the major concerns for the company.

Ebit Margin Analysis

2008

2009

2010 (Fcst)

Income Before Taxes

8600

2140

55

EBIT Margin

8.69%

2.02%

0.05%

From the above analysis it is clear that at operating level company is having reduced margins every year and if the trend continues it will be dooms day for the company soon. Let us see the trend from the graph which is shown below.

Possible reasons for the Rising Cost

1. Extra cost applied by the company at some levels which is not providing adequate profitability as expected

2. Some of the product line have reached product maturity stage and hence are facing reduced margins.

Analysis

Company has shown increased headcount and this can be one reason why the company is facing such high escalating cost. The risen for the increased headcount can be the expected demand and the failed results.

2008

2009

2010 Fcst

Margin %

Margin %

Margin %

Screws

Television

25%

26%

21%

Computers

48%

44%

43%

Medical

47%

50%

38%

Automotive

21%

18%

12%

Screw Total

29%

26%

23%

Product profitability analysis suggests that the products margin have reduced in every segment and the maximum hit is taken by Medical and Automotive Segment. One reason that can be attributed to it is the economic downturn. Company needs to discontinue the products which are not profitable and facing huge margins pressure.

2008

2009

2010 Fcst

Margin %

Margin %

Margin %

Connectors

Television

25%

23%

19%

Computers

29%

21%

22%

Medical

58%

53%

49%

Automotive

25%

26%

18%

Connector Total

30%

25%

23%

Same is the trend in the connector segment also. The margins have taken a huge hit at operating level. The main reason for this was the decline in medical and automotive segment.

Balance Sheet Analysis

2008

2009

2010 Fcst

Assets

Cash

250

130

100

Accounts Receivables

5400

6700

8500

Inventory

6700

9200

12000

Total Current Assets

12350

16030

20600

Net Plant & Equipment

1500

1530

1700

Total Assets

13850

17560

22300

Liabilities

Accounts Payables

3000

3100

4500

Notes Payables

400

600

1200

Accured Taxes

300

550

900

Current portion of long-term Debt

200

200

200

Total Current Assets

3900

4450

6800

Long-term Debt

1800

1700

1600

Shareholders’ equity

8150

11410

13900

Total Liabilities and Net Worth

13850

17560

22300

We tried matching up reasons of cost escalation for the company by having a look at asset side of the balance sheet. Company’s cash level has gone down and the accounts receivables are on an ever increasing trend. This is a calamity of the company. Company is not able to create churns in the business. The profit made is stored in books only because cash needs are not meet. Whenever an organisation is not able to meet cash needs it needs streamline in its operations to cater to need.

Cost is also increasing for last two years because company is holding onto inventory. As we don’t have idea about the inventory holding cost, we cannot comment on it. But one thing is sure margins are hit at some levels for sure because of this huge inventory pile up for the company.

Conclusion

This analysis suggests that the company needs to revamp the cost structure at all levels and discontinue some not so profitable products. Company needs to revamp the cost methods and make the necessary changes in the operations of the company. The revenues of the company have been on the rise but the problem with the company is in the ever rising costs of goods sold. This can be raw material, packaging and value additive service. Company has shown increased headcount and this can be one reason why the company is facing such high escalating cost. The risen for the increased headcount can be the expected demand and the failed results. Product profitability analysis suggests that the products margin have reduced in every segment and the maximum hit is taken by Medical and Automotive Segment. One reason that can be attributed to it is the economic downturn. Company needs to discontinue the products which are not profitable and facing huge margins pressure. Company’s cash level has gone down and the accounts receivables are on an ever increasing trend. This is a calamity of the company. Company is not able to create churns in the business. The profit made is stored in books only because cash needs are not meet. Whenever an organisation is not able to meet cash needs it needs streamline in its operations to cater to need. Cost is also increasing for last two years because company is holding onto inventory. As we don’t have idea about the inventory holding cost, we cannot comment on it. But one thing is sure margins are hit at some levels for sure because of this huge inventory pile up for the company.

Read

More

CHECK THESE SAMPLES OF Financial Performance Analysis

Financial Performance Analysis of Fuller Smith and Turner Plc Group

As the paper "Financial Performance Analysis of Fuller Smith and Turner Plc Group" tells, the ratios can be divided into such categories as profitability, gearing, and liquidity, each focusing on areas of the financial outlook of the organization and highlighting the company's performance.... he company under consideration is Fuller Smith and Turner Plc Group and in this report analysis of the financial performance of the company over two years has been conducted to draw attention to various financial trends and significant changes over the period....

12 Pages

(3000 words)

Essay

Gentiva Health Services Financial Analysis

The author of the paper titled "Gentiva Health Services Financial Analysis" evaluates the financial performance of Gentiva Health Services Company and gives a conclusion based on the author's point of view on the soundness of the company's activities.... As a result of these sales, there are short-lived and long-term effects on the expenditures and revenues earned by the company (financial performance)....

10 Pages

(2500 words)

Term Paper

Financial Analysis of Pace Plc

It is quite important to say that the analysis in this report shows a strong and improving financial performance for the company in the aftermath of the global economic crisis.... The evidence shows support in favour of improved financial performance in 2008 and 2009 and is still going on increasing.... In this report, the financial performance of Pace Plc listed in the London Stock Exchange is analyzed.... The objective of the study is to analyze the financial performance of the group and to recommend whether or not to invest in the company's shares based on the analysis....

10 Pages

(2500 words)

Case Study

Financial Performance for Sparklin Automotive Company

Moreover, the report also discusses other possible methods for Financial Performance Analysis, which could have been used to analyze the performance of Sparklin Automotive Company.... This paper "financial performance for Sparklin Automotive Company" presents a brief analysis of the performance of Sparklin Automotive Company during the financial year 2010 and 2011.... Ratio analysis refers to the financial analysis tool through which financial analysts carry out the analysis of a company's financial performance by conducting a quantitative analysis....

6 Pages

(1500 words)

Case Study

Gillette Company Financial Performance Analysis

The essay "Gillette Company Financial Performance Analysis" focuses on the critical analysis of Gillette Company's financial performance.... The main types of profitability ratios that may be imperative in the analysis of Gillette Company's financial performance have been discussed....

5 Pages

(1250 words)

Essay

Financial Performance Analysis and Management Accounting for William Hill PLC

This research paper describes Financial Performance Analysis and management accounting for William Hill PLC.... Part A will focus on financial performance by employing ratio analysis as a tool.... To give a detailed account of William Hill's financial performance, I am going to use profitability and investment ratio.... It describes the analysis of profitability and investment of its company in the last four years.... The profitability analysis encompasses analyzing gross and net profit margin, ROE and ROCE....

13 Pages

(3250 words)

Research Paper

Balanced Scorecard and Strategy Map of Home Retail Group

The paper will provide an analysis of the financial performance of the company using both 2013 and 2014 financial statements.... Additionally, the report will provide a strength and weakness analysis of the company's operations.... The analysis will help provide solutions for improving the liquidity position of the company and pinpoint any misstatements in the financial statements.... Kaplan and Norton established the tool as a performance measure in order to provide the board of....

11 Pages

(2750 words)

Financial Performance Analysis of David Jones Limited

The paper 'Financial Performance Analysis of David Jones Limited' is a fascinating example of a finance & accounting report.... This paper is a report of the Financial Performance Analysis of David Jones Limited and its controlled entities.... The paper 'Financial Performance Analysis of David Jones Limited' is a fascinating example of a finance & accounting report.... This paper is a report of the Financial Performance Analysis of David Jones Limited and its controlled entities....

11 Pages

(2750 words)

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"Financial Performance Analysis"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY