StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Profit and Shareholder Wealth

Free

Profit and Shareholder Wealth - Assignment Example

Summary

In the paper “Profit and Shareholder Wealth” the author compares Tyco's and GE’s market capitalization The ratio of market capitalization relative to stockholders' equity was 1.22 to 1. GE's market capitalization was $264,820M; its stockholder's equity was 115,559M…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER91.6% of users find it useful

- Subject: Finance & Accounting

- Type: Assignment

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

Extract of sample "Profit and Shareholder Wealth"

TYCO & GE: Profit and Shareholder Wealth Comparison Divide each company’s market capitalization by that company’s shareholders’ equity. This market-to-book ratio provides one measure of shareholder wealth created by each company. Include your calculations in the assignment.

Tycos market capitalization for 2007 was $19,092.52M; its stockholders equity was $15,624.00m The ratio of market capitalization relative to stockholders equity was 1.22 to 1.

GEs market capitalization was $264,820M; its stockholders equity was 115,559M. The relevant ratio for GE was 2.29 to 1.

2) Based on these market-to-book ratios, which company’s strategy has provided greater shareholder wealth creation?

GE provided greater shareholders wealth because the market value of its shares was 2.29 times that of book value. Tyco, on the other hand, had a much lower ratio of 1.22 to 1. This means that over the years investment in GE appreciated more than the investment in Tyco, and has potential for performing consistently well in the future. With an average beta of .64, as computed by Yahoo and Reuters, GE is also a lot more stable than Tyco, whose beta is .93.

3) Calculate the average net profit margin for each company for the five years worth of data obtained. Include your calculations in the assignment.

The net profit margins of the two companies are as follows:

Tyco 2007 2006 2005 2004 2003

Revenues 18,781.0 17,336.0 16,665.0 37,939.0 34,256.0

Net income (loss) (1,742.0) 3,590.0 3,094.0 2,822.0 980.0

Net profit margin ( .0927 ) 0.207 0.186 0.074 0.029

5-year average net

profit margin .081

GE

Revenues 169,719.0 149,689.0 134,907.0 133,227.0 112,819.0

Net income 22,208.0 20,742.0 16,720.0 17,160.0 15,561.0

Net profit margin 0.131 0.139 0.124 0.129 0.138

5-year average net

profit margin 0.132

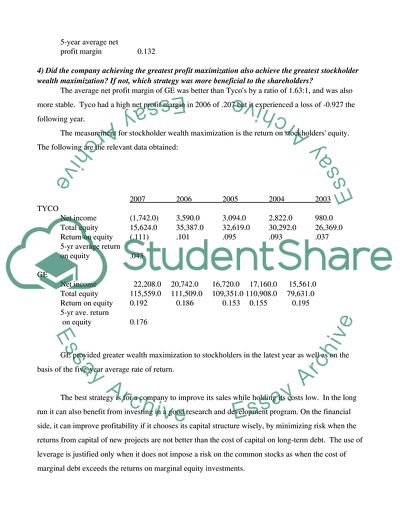

4) Did the company achieving the greatest profit maximization also achieve the greatest stockholder wealth maximization? If not, which strategy was more beneficial to the shareholders?

The average net profit margin of GE was better than Tycos by a ratio of 1.63:1, and was also more stable. Tyco had a high net profit margin in 2006 of .207 but it experienced a loss of -0.927 the following year.

The measurement for stockholder wealth maximization is the return on stockholders equity. The following are the relevant data obtained:

2007 2006 2005 2004 2003

TYCO

Net income (1,742.0) 3,590.0 3,094.0 2,822.0 980.0

Total equity 15,624.0 35,387.0 32,619.0 30,292.0 26,369.0

Return on equity (.111) .101 .095 .093 .037

5-yr average return

on equity .043

GE

Net income 22,208.0 20,742.0 16,720.0 17,160.0 15,561.0

Total equity 115,559.0 111,509.0 109,351.0 110,908.0 79,631.0

Return on equity 0.192 0.186 0.153 0.155 0.195

5-yr ave. return

on equity 0.176

GE provided greater wealth maximization to stockholders in the latest year as well as on the basis of the five-year average rate of return.

The best strategy is for a company to improve its sales while holding its costs low. In the long run it can also benefit from investing in a good research and development program. On the financial side, it can improve profitability if it chooses its capital structure wisely, by minimizing risk when the returns from capital of new projects are not better than the cost of capital on long-term debt. The use of leverage is justified only when it does not impose a risk on the common stocks as when the cost of marginal debt exceeds the returns on marginal equity investments.

Both the return on revenues/sales and the return on equity should have a direct relationship, that is to say, the net profit margin should be reasonably high consistent with the return on stockholders equity. However, the net profit margin may be low in relation to revenues, particularly when the industry is highly competitive and companies survive on thin profit margins and compensate by increasing sales volumes. The ultimate measure of profitability is the net return on the shareholders equity, and not the net profit margin whenever there is a doubt as to which of these are paramount.

5) Which company’s strategy has presented greater risk to the shareholders’ investment?

The degree of risk which investors or shareholders are exposed to depend firstly on how management handles the marketing function, because that is where income is generated. When little sales are generated, income can shrink or even turn into a loss because of fixed costs incurred regardless of sales level. The cost structure must also be managed well because the high costs can erode the operating margins even if revenues are high. The second most important factor that can expose shareholders to significant risk is the amount of debt incurred by the company. The debt-to-equity ratio must be normal for the industry - neither too low so as to miss out on profitable investment opportunities which can be availed of by using debt, nor too high as to threaten the stockholders equity in case of project failure and debt default. In fact, the higher the debt ratio, the higher would the stockholders required return on their capital. An optimal capital structure must be maintained by company management which primarily takes into account how leverage can contribute to the net returns to stockholders.

The debt ratios of the two companies are shown below:

TYCO

Total liabilities 17,191.0 27,624.0 29,846.0 33,375.0 36,628.0

Long-term debt 4,076.0 8,853.0 10,569.0 14,542.0 18,251.0

Total equity 15,624.0 35,387.0 32,619.0 30,292.0 26,369.0

Debt to equity ratio 1.10: 1 0.78: 1 0.91: 1 1.10: 1 1.39: 1

5-year ave. D/E ratio 1.06: 1

G E Total liabilities 679,778.0 585,174.0 563,970.0 639,709.0 568,197.0

Long-term debt 319,015.0 260,752.0 212,281.0 207,871.0 171,966.0

Total equity 115,559.0 111,509.0 109,351.0 110,908.0 79,631.0

Debt to equity ratio 5.88: 1 5.25: 1 5.16: 1 5.77: 1 7.14: 1

5-year ave. D/E ratio 5.84: 1

6. Have the investors assuming that greater risk been rewarded with greater investment returns?

Despite high leverage on the part of GE, investors continued to support GE. Latest Price/Earnings ratio according to Reuters was 12.05. and price per share was holding at $26 to $28 per share. The risk the company takes is in the amount of leverage. In ordinary circumstances, investors would push the price down because high leverage can mean insolvency risk. However GE is a stable company with a very good record of earnings and dividends over many years, and its stability, shown by its low beta, is outstanding.

Tyco experienced negative earnings in 2007; however, in the most recent quarter ending June 2008, it showed a net profit margin of 6.45%, according to data provided by Yahoo. Its price has also stabilized at around $40 per share for most of this current year. It is very likely that Tyco will recover and that its investors will be show better investment results by the end of this year.

REFERENCES

Brealey, C.P., Myers, S.C., Marcus, A.J. (1999) Fundamentals of Corporate Finance (2nd ed.). Boston:Irwin/ McGraw-Hill

Jackson, S. & Sawyers, R. (2001). Managerial accounting: A focus on decision making. Orlando, FL:Harcourt, Inc.

Stickney, C.P. (1990). Financial statement analysis: A strategic perspective (2nd ed.). Orlando, FL: Dryden Press.

Websites visited and used:

http://finance.yahoo.com/q/ks?s=TYC

http://finance.yahoo.com/q/ks?s=GE

http://www.tyco.com

http://www.ge.com

http://www.reuters.com/finance/stocks/overview?symbol=TYC.N

http://www.reuters.com/finance/stocks/financialHighlights?symbol=GE.N

http://www.reuters.com/finance/stocks/incomeStatement? stmtType=INC&perType=ANN&symbol=GE.N

http://www.reuters.com/finance/stocks/performance?symbol=GE.N

Read

More

CHECK THESE SAMPLES OF Profit and Shareholder Wealth

The contemporary perception of shareholder theory: a discouse on the shareholder-stakeholder debate

The Contemporary Perception of Shareholder Theory: A Discourse on the Shareholder-Stakeholder Debate Essay Name Name of Professor Introduction The main objective of organisations or management to maximise shareholder wealth has been strongly challenged recently.... The most credible explanation for increasing shareholder wealth was given by Milton Friedman.... A management who is unable to increase shareholder wealth are disobeying and disregarding this expectation....

11 Pages

(2750 words)

Essay

Maximising Shareholder Wealth vs. Corporate Governance and Stakeholder Theory: Tracing the Debates

Maximizing shareholder wealth vs.... Corporate Governance and Stakeholder Theory: Tracing the Debates It is imperative to trace the debates between the competing schools of thought with respect to making shareholder wealth maximization the primary overriding goal of a corporation.... Krishnan2 summarises cogently the shareholder wealth maximization theory: This paradigm is built upon the classic competitive markets assumption.... This paper argues that instead of wealth generation for shareholders, the underlying principle that should inform decision-making processes of corporations should be the improvement of corporate governance....

12 Pages

(3000 words)

Term Paper

Analysis of Shareholders Value

In the recent past, companies are adopting the value-based management approach which is a formal systematic approach used in managing companies to achieve the objective of maximizing value creation and shareholder value (Chapman, Hopwood, & Shields, 2009, p.... "Analysis of Shareholders Value" paper argues that a good measure of the shareholder's value reduces the stakeholder conflicts between shareholders and the management.... shareholder value is the measure of a company's success in the extent to which it enriches shareholders through management's ability to grow earnings, dividends, and share prices....

4 Pages

(1000 words)

Essay

Critical Evaluation Of Shareholder Wealth Maximisation

The aim of this paper is to analyze the critical evaluation of the shareholder wealth maximization axiom.... As we enter the 21st century, calling it the postindustrial era or postmodern era, the moral status of the shareholder wealth maximization for the corporate activity has changed.... shareholder wealth maximization is exempt for moral scrutiny, within the disciplines of financial economics and corporate culture.... This concept is undeniably protected against the critics by the theory of invisible hand that each individual company that competes in pursuit of shareholder wealth maximization ultimately leads to maximum cumulative economic advantage....

7 Pages

(1750 words)

Research Paper

Financial Management in Banks

ike any other firm, the ultimate objective of banks and financial institutions is to maximize Profit and Shareholder Wealth.... Maximization of Profit and Shareholder Wealth is only possible if banks perform its fundamental activities i.... The preceding paragraphs elaborate the use of financial management in banks for the maximization Profit and Shareholder Wealth and the importance of risk management techniques in this regard.... Managing risk is important for the purpose of Profit and Shareholder Wealth maximization....

4 Pages

(1000 words)

Essay

Maximizing Financial Returns for Shareholders

The article "Maximizing Financial Returns for Shareholders " points out that the importance of shareholder wealth and value in business and financial dealings will be discussed.... After an introduction to what financial and profitability would mean to shareholders, the different factors that affect profitability and contribute to maximizing shareholder wealth, the examples and evidence of shareholders' returns and company policies and strategies will be analyzed....

7 Pages

(1750 words)

Article

Advantages, Disadvantages, and Future Perspectives of Enlightened Shareholder Value Approach

It is a theory that includes the concept that the main purpose of businesses is to establish profits and increase the sharing of wealth.... The current application of the shareholder theory is based on the Chicago School of Economics which highlighted the fact that the primary purpose of corporations is to maximize the wealth of shareholders; this theory also argues that resolving social issues are state function, not corporate function [1].... Sharing wealth through philanthropy is therefore considered a useless enterprise for the corporation; in some instances, it may even be considered immoral because it is as good as stealing from the shareholders....

17 Pages

(4250 words)

Coursework

The Effect Stakeholder and Shareholder Theories have on Director's Duties

On the other hand, when debated in its 'instrumental' variations, - that the managers ought to attend to the stakeholders as a means towards achieving other goals at the organizational level, for instance, shareholder wealth maximization or profit-the stakeholder theory remains nearly unopposed.... The paper "The Effect Stakeholder and shareholder Theories have on Director's Duties" is a great example of a literature review on finance and accounting.... The paper "The Effect Stakeholder and shareholder Theories have on Director's Duties" is a great example of a literature review on finance and accounting....

9 Pages

(2250 words)

Literature review

sponsored ads

Save Your Time for More Important Things

Let us write or edit the assignment on your topic

"Profit and Shareholder Wealth"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY